Apple Stock After Product Announcements

Apple Stock After Product Announcements

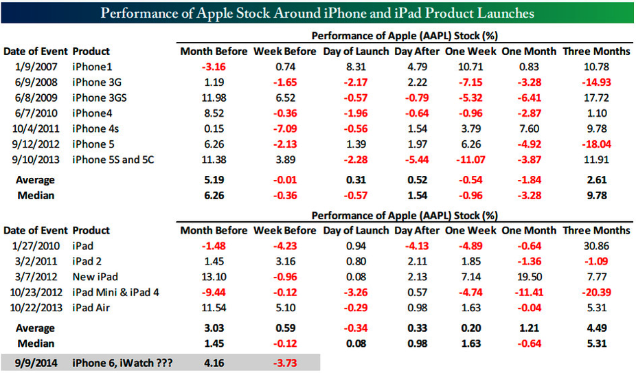

Apple's new products will be announced in an hour. This morning we saw an interesting study done by Bespoke Investment Group on how AAPL stock behaves just before and just after each new product announcement since 2006. The summary is that AAPL has averaged 5.2% gain in the month prior to the announcement and a 1.8% decline in the month after the announcement.

So far, with the iPhone 6 and iWatch announcements coming today, the shares are up 3.8% for the month prior, but that's after they're down 4% from last week.

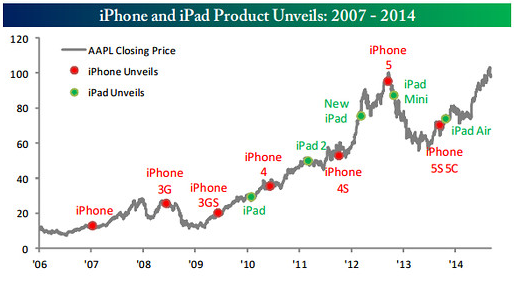

This chart, also from Bespoke, shows AAPL stock price along with each new iPhone (in red) and iPad (in green) product announcement:

As we write this (9am on Sep 9) AAPL is at 99.40, up $1 for the day (when the DJIA is down 70 points). Investors are placing bets on a higher-than-average "wow" factor for today's unveilings, which begin in 1 hour.

Taking Advantage With Covered Calls

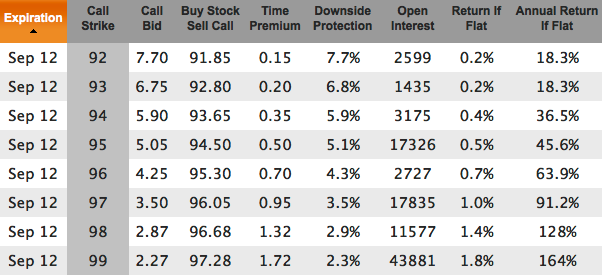

Covered call investors can take advantage of these in-the-money buy-writes to capture some of the hype premium:

If you assume the historical 2% decline in stock price after the announcement then the Sep 12 97-strike would be your best bet. More aggressive investors could use higher strikes, and more conservative investors could use a lower strike. And if you're long-term bullish on AAPL then you don't have to cover all of your position, or you could use out-of-the-money strikes, or just buy some more AAPL for a short-term trade this week.

Sep 12, 2014: Post-expiration followup... AAPL closed at 101.66 making all of the covered calls shown above profitable.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.