Dividend Champions Covered Calls

Dividend Champions Covered Calls

Dividend Champions are those companies that have raised their dividends for 25 years in a row or more.

Given their long history of increasing dividends, it is likely they will continue to do so. Wouldn't it be nice if you could predict when they would next increase their dividends, and buy some shares to write covered calls in advance of that?

David Fish of Moneypaper wrote about Dividend Champions Ready to Raise Payments where he points out that the majority of champions have a habit of announcing dividend increases about the same time each year. Normally the announcements come between 2 days and 2 months before the ex-dividend date. In fact, he claims that 90% of the time these dividend increases can be predicted.

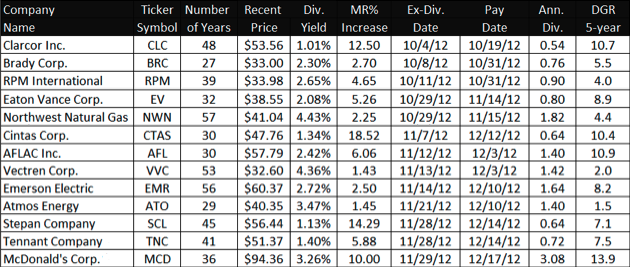

On Deck For A Near-Term Dividend Increase

David identified 18 companies that are within the window of "about to increase their dividend" based on past behavior and last year's dates. 13 of the 18 have options available, which are:

(column headings: Number of Years = consecutive years of higher dividends, MR = Most Recent, DGR = Dividend Growth Rate)

Dividend Champions With Covered Calls

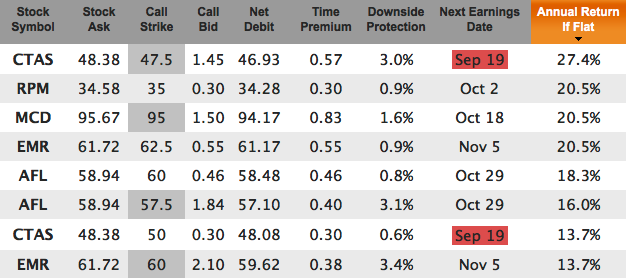

If you take those 13 symbols and plug them into Born To Sell's Watchlist feature, you find several candidates for Sept covered calls that yield 1%/month or more on an annualized basis:

However, those expire September 21st and may not have enough time for the dividend increases to be announced. But you could do the Sept cycle and when the time premium is near zero (or just wait until after expiration) roll them to October.

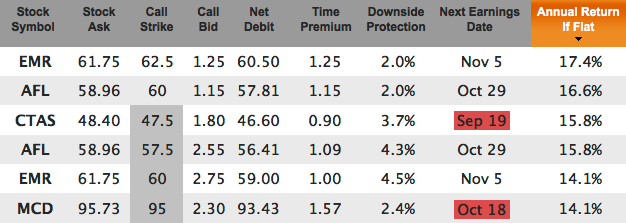

If you want to start with the October 19 expiration date today, you get:

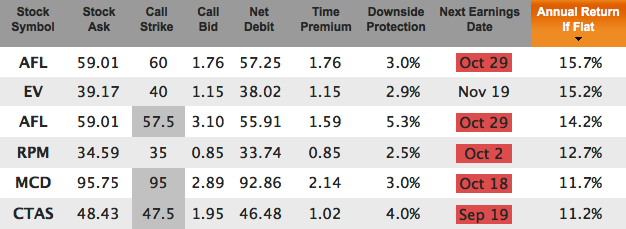

And if we go out to the Nov 16 expiration:

However, many of these have a scheduled earnings release date prior to the option expiration date, so if you don't want earnings volatility then stay away from covered calls that have a 'Next Earnings Date' in red.

Note: These are not trade recommendations. These are candidate trades with likely dividend increases coming. Do your own research, keep position sizes modest, and stay diversified.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.