Rising Interest Rates

Rising Interest Rates

Many experts agree that we will experience rising interest rates in 2011. If the economy falters and the dollar weakens, rates will rise as the US debt rating comes under pressure. Or, if the economy recovers then higher employment will increase inflation which will cause interest rates to rise. Either way, it looks like rates are heading higher.

The important question is: If you agree with this then how can you profit? There are several ETFs that will rise as interest rates are rising and, even better for us covered call writers, they are optionable (meaning you can sell call options against them).

Interest Rates Rising -> Bond Prices Falling

It is well-known that when interest rates go up bond prices go down. If you hold the bonds to maturity then, assuming no default, you will get the principle and interest you were expecting. However, if your bonds mature in many years then in the near term you will have a paper loss as their value drops (and if you sell before they mature then you will likely have a realized loss).

Interest Rates Rising -> Inverse Bond ETFs Also Rising

There are several inverse bond ETFs that will rise in value as bond prices fall. Some are leveraged, which makes them poor choices for long term holdings, but an okay choice for shorter term if your timing is correct. Depending on your risk tolerance, these can be good candidates for short-term covered calls. Here are the popular ones:

| Most Popular Inverse Bond ETFs by Market Cap (Dec 2010) | ||||

| Symbol | Name | Leverage | Avg Vol | Mkt Cap |

|---|---|---|---|---|

| TBT | ProShares UltraShort Barclays 20+ Year | 2x | 13,114,800 | $5.5B |

| TBF | ProShares Short 20+ Year | none | 370,525 | $0.8B |

| PST | ProShares UltraShort Barclays 7-10 Year | 2x | 232,949 | $0.5B |

The only one with meaningful open interest on the option side is TBT. If you want to make a one-month or less bet on rising interest rates, TBT is probably the best choice. However, because it is 2x leveraged you may want to go 1 or 2 strikes deeper in the money than you are used to. If you have any bonds in your portfolio (that you plan on keeping as rates are rising) then investing in some TBT covered calls could act as a hedge against those interest rate increases.

| Symbol | Price | Trade | Annualized Return If Flat |

|---|---|---|---|

| TBT | 37.04 | Sell Jan 34. Net debit 33.88 | 6.6% |

| TBT | 37.04 | Sell Jan 35. Net debit 34.66 | 16.6% |

| TBT | 37.04 | Sell Jan 36. Net debit 35.34 | 31.5% |

| TBT | 37.04 | Sell Jan 37. Net debit 35.86 | 53.1% |

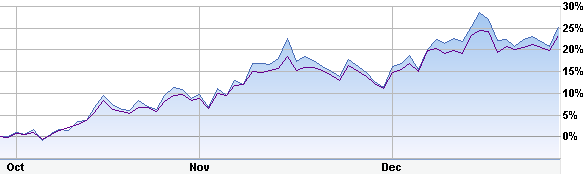

The following chart shows that TBT closely tracks the 30 Year Bond Index. If you believe long term bond rates will rise, TBT could be a good choice:

TBT percent change (blue) and 30 Year Bond Index (purple), Oct-Dec 2010

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.