Target (TGT) Trades February 19

Target (TGT) Trades February 19

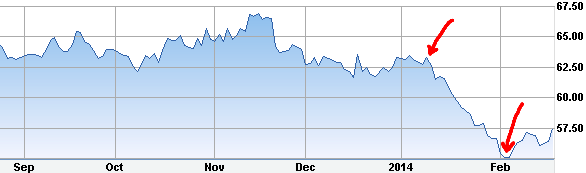

Target (TGT) fell from $63 to $55 because of their credit card data breach that was revealed in early January. In the last few days the stock is starting to come back, including showing strength today where TGT is up over 1% when the market is down:

TGT Stock Price Last 6 Months

People are not going to stop shopping at Target. This data breach episode shall pass for this otherwise strong company. Now would be a reasonable time to put on a covered call trade to take advantage of the last 30 days of weakness.

The only wrinkle is that earnings are expected to be announced Feb 26 before the open. Like all earnings announcements, this could be a volatile event for the stock. While it may shoot up, more conservative investors will want to look at in-the-money strikes.

At this moment, the stock is trading at 57.41. Here are the returns for buy-writes that are at-the-money or slightly in-the-money for 3 different expiration dates:

| Expiration | Strike | Call Bid | Net Debit | Days To Expiration |

Annualized Return If Flat |

|---|---|---|---|---|---|

| Feb 28 | 55 | 2.73 | 54.69 | 10 | 22% |

| Feb 28 | 57 | 1.33 | 56.09 | 10 | 58% |

| Mar 7 | 55 | 2.88 | 54.54 | 17 | 17% |

| Mar 7 | 57.50 | 1.25 | 56.17 | 17 | 47% |

| Mar 22 | 55 | 3.05 | 54.37 | 31 | 14% |

| Mar 22 | 57.50 | 1.49 | 55.93 | 31 | 32% |

All of these have a Net Debit of 56.17 or lower, which is not a terrible cost basis to own the stock, should it not get called. The conservative 1% per month crowd will probably like the Mar 22 55-strike, while more aggressive investors will probably like the Feb 28 57-strike. And if you're really bullish on TGT then consider some out-of-the-money covered calls at this time.

As always, this is not a trade recommendation; it's just an idea to get you thinking. Do your own homework to determine suitability for your account.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.