3 Tech Stocks For Covered Calls

3 Tech Stocks For Covered Calls

A couple weeks ago Tom Taulli of InvestorPlace wrote about 3 beaten down tech stocks that he felt were worth buying: IBM, CSLT, and YELP. We agree with him that IBM and YELP are reasonable tech stocks, but CSLT has so little option activity that it is a poor choice for covered call investors. For this article, we're replacing it with AAPL.

Why These 3 Tech Stocks?

Tom's reasons for adding IBM to his list include: (1) tremendous platform, (2) a history of adapting changing markets as a corporation, (3) recent partnership with AAPL on mobile device apps, (4) major player in big data and cloud, (5) P/E of 13 (compared to MSFT's 17 and ORCL's 18).

His reasons for adding YELP to his list include: (1) over-reaction to recent disappointing earnings, (2) increasing revenue, (3) strong in mobile, (4) tripling it's marketing budget in 2015, and (5) huge market opportunity still ahead of them.

AAPL was not on Tom's list. We added it because, well, everyone owns it or trades it, and it historically has been very good for weekly (or monthly) covered call writing.

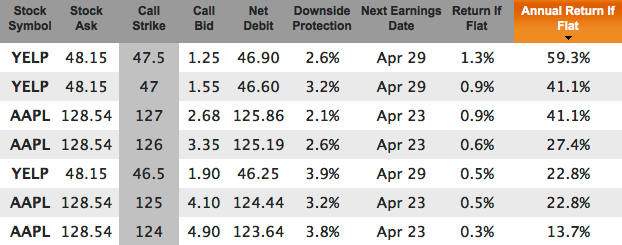

In The Money Weekly Tech Stock Trades

All 3 of these symbols trade weeklys (see complete list of weeklys), and none of them have ex-div dates or earnings dates until end of April. If we look at some in-the-money choices for the weekly March 6 expiation, we find several in-the-money candidates that exceed 1%/month return (12% annualized):

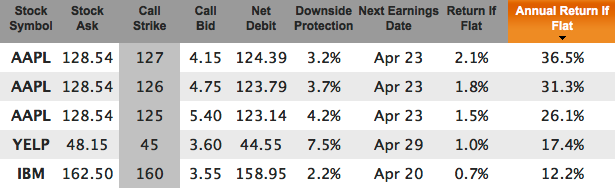

If we go out to the monthly expiration of Mar 20 then we can add IBM to the 1%/month in-the-money club:

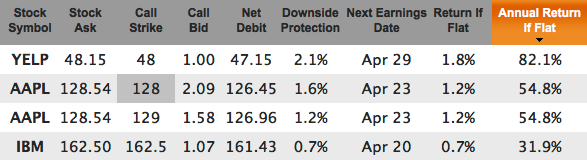

At The Money Weekly Tech Stock Trades

For any symbol, the highest annualized return is almost always with the at-the-money strike. Here are the choices for the Mar 6 at-the-money weeklys:

And the Mar 20 at-the-money monthlies:

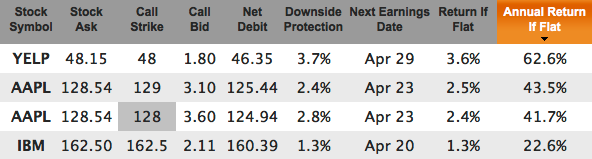

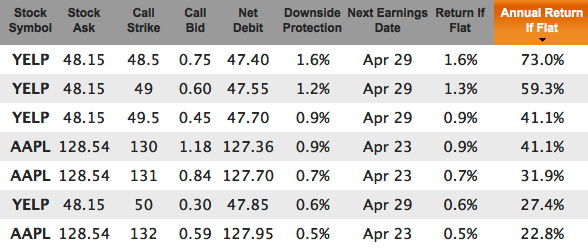

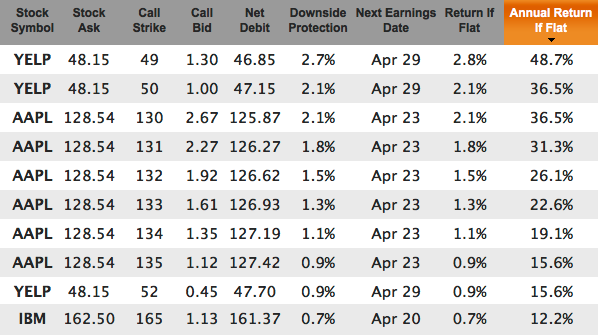

Out Of The Money Weekly Tech Stock Trades

Lastly, if you're more bullish on these stocks, and want to leave some room for upside potential, there are some out of the money trades that have an if-flat (meaning stock remains unchanged) annualized return well over 1%/month:

And the Mar 20 out-of-the-money monthlies that yield more than 1%/month:

Note: These out of the money options are presented with "if flat" returns. Those returns are just from the time premium of the option. They do not consider that the underlying stock might change between now and expiration. Should the stocks go up and get called away, the "if called" returns would be much higher (likewise, should the stocks drop, there is less downside protection in these out-of-the-money options compared to their ATM and ITM counterparts).

As always, these are not recommendations. They are merely starting points for your own due diligence. Keep positions small. Stay diversified. Live long and prosper.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.