Apple (AAPL) Trades February 2

Apple (AAPL) Trades February 2

Last week Apple announced the most profitable quarter of any company ever. AAPL is flirting with new highs based on that report. Furthermore, as an example of how much institutions like this company, today AAPL sold $6.5B of bonds with a 10-year yield of 0.85 over Treasurys (bankers said Apple had demand for over $15B of the bonds, even at that low interest rate). The fact that AAPL can demand such low interest shows you how credit worthy they are (having $178B in the bank probably helps improve their credit rating).

Dividend on Thrusday

This week AAPL has an ex-dividend date of Feb 5 for a 47 cent dividend, meaning you need to own the stock by the close on Feb 4 in order to receive the dividend. Income investors could do well on a short-term trade trade here.

In-The-Money Weekly Trades On AAPL

An in-the-money weekly covered call would capture both time premium and dividend on an underlying stock that most investors would be comfortable holding past Friday, should the stock not get called away. The returns shown here include both the time premium and the dividend income, assuming the position is called away at expiration.

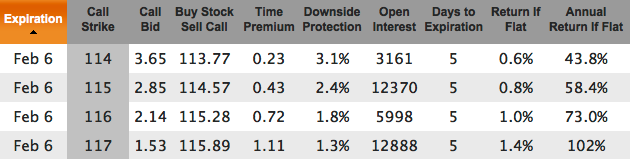

Feb 6 Expiration

AAPL is trading at $117.42 right now. For a 5-day trade (more like 4 since it's an hour to close on Monday as we write this), here are several in-the-money covered call choices for this Friday's expiration:

Pay attention to the Time Premium column. You want to be sure to sell an option that has enough time premium that the option holder won't take early exercise so that he can get the dividend instead of you. Since he forfeits any remaining time premium when he exercises, you want enough in there to persuade him not to exercise).

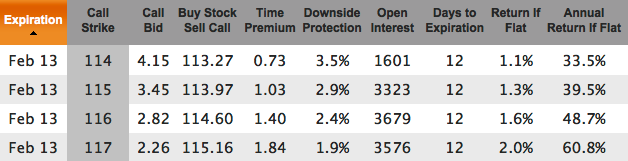

Feb 13 Expiration

If you want to go out 12 days then here are the in-the-money choices for Feb 13:

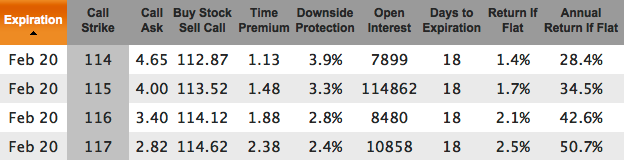

Feb 20 Expiration

If you'd like to use the monthlies instead of the weeklys (they have much higher open interest and, as a result, smaller spreads and greater liquidity) here are the Feb 20 expiration in-the-money covered calls:

With returns over 1% in 3 time frames (5-day, 12-day, and 18-day), and annualized returns much higher, you have a nice selection of high yield investments on a quality stock to choose from here.

Feb 6, 2015: Post-expiration followup... AAPL closed at 118.93 on Feb 6. All of the Feb 6 strikes shown finished in the money, were called, and the Annualized Returns shown above were realized.

Feb 6, 2015: Post-expiration followup... AAPL closed at 118.93 on Feb 6. All of the Feb 6 strikes shown finished in the money, were called, and the Annualized Returns shown above were realized.

Feb 13, 2015: Post-expiration followup... AAPL closed at 127.08 on Feb 13. All of the Feb 13 strikes shown finished in the money, were called, and the Annualized Returns shown above were realized.

Feb 20, 2015: Post-expiration followup... AAPL closed at 129.50 on Feb 20. All of the Feb 20 strikes shown finished in the money, were called, and the Annualized Returns shown above were realized.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.