| Use The Force |

|

Only 17 days until the opening of the next Star Wars movie: The Force Awakens. Advance ticket sales have broken all records. Fandango's servers crashed and the AMC chain sold out over 1000 screenings in 12 hours (and that was 2 months before the opening date). The movie will be the biggest December opening in history, and should do $2B in total ticket sales globally.

So, how to play for the win with covered calls?

A lot of the good news is already out but there's potential for additional upside. There are at least two companies you can bet on: DIS (who owns The Force Awakens) and EA (who is releasing a game based on the movie).

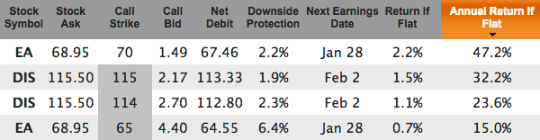

If we look at DIS and EA covered calls for the Dec 18 expiration (which happens to be opening day for the movie), we find 4 that offer 15% or more annualized return:

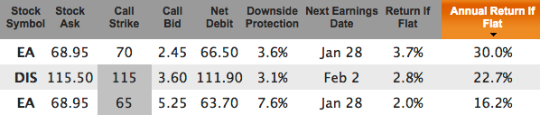

Going out to the Jan 15 expiration (about a month after the movie has opened) there are 3 covered calls that offer 16% or more annualized return:

Now, one movie does not a company make. However, the Force is strong with these two companies, and there are many ways to win for years to come.

|

| All I Wanted For Xmas Was Time Premium |

|

If you are like a lot of investors, you're difficult to shop for. You probably buy what you want when you see it. Well, in an effort to help those around you give you something that you won't immediately return (or if you just want to do more self-shopping), we'd suggest these links:

You're welcome.

|

| Born To Sell Subscriber Nets $3.4M |

|

A big CONGRATS to Born To Sell subscriber Neil Blumenfield who finished in 3rd place in this year's televised World Series Of Poker Main Event. Quite the accomplishment given a field of 6,420 entrants. A big CONGRATS to Born To Sell subscriber Neil Blumenfield who finished in 3rd place in this year's televised World Series Of Poker Main Event. Quite the accomplishment given a field of 6,420 entrants.

Neil won $3,398,298 pre-tax and should have slightly less than $2M post-tax to invest in covered calls. With a 1%/month goal (12%/year) that's about $20K/month income (pre-tax).

And if you need something for that special lady in your life, Neil's girlfriend Pascale owns an upscale boutique called Pascaline Paris in Pacific Heights (San Francisco). Stop on by if you're in the area (they also offer online ordering).

|

| Boring Old W.W. Grainger |

|

W.W. Grainger is not on a lot of people's watchlists. However, this Dividend Aristocrat has raised its dividend for 43 consecutive years. They are in the maintenance, repair, and operations (MRO) industry. W.W. Grainger is not on a lot of people's watchlists. However, this Dividend Aristocrat has raised its dividend for 43 consecutive years. They are in the maintenance, repair, and operations (MRO) industry.

Boring? Perhaps. Consistently increasing dividends? Yes. Super high option premiums? No. But for investors with conservative return goals, this could be a low risk choice.

The stock currently trades at 201.64. There are at least 3 ways to make about 10% annualized return with GWW (not including 2.3% annual dividend):

| Expiration | Strike | Call Bid | Annualized Return If Flat |

|---|

| Dec 18, 2015 | 210 | 1.00 | 10.7% |

| Jan 15, 2016 | 210 | 2.65 | 10.5% |

| Apr 15, 2106 | 210 | 7.20 | 9.7% |

One thing to note is that the spreads on GWW are quite wide, so you could do better than the above return numbers if you put in a limit order to sell the call at the midpoint of the bid and ask. If not filled then you can lower the limit by 5 cents every 30 seconds or so until filled.

To read more about W.W. Granger and why it might make sense as an addition to a conservative portfolio, please see TheStreet's article Overlooked Dividend Aristocrat Has Potential for 20% Annual Total Returns.

|

| 4 Blue Chip High-Dividend Stocks |

|

Yesterday 24/7 Wall Street screened Jeffries Franchise Picks to come up with 4 high-yield dividend members. They are: ABBV, BA, T, and WDC.

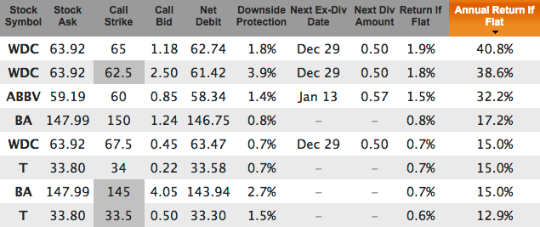

You can read their article as to why they chose these 4 high yield companies. If you like them but want some additional yield, then you can write Dec 18 covered calls on them to achieve returns over 12%/year:

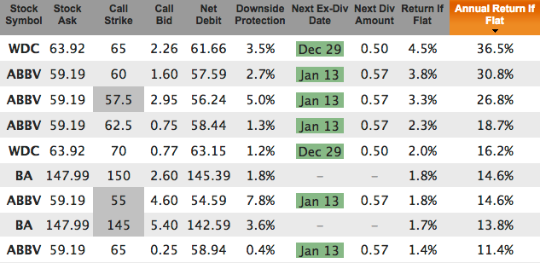

None of these have earnings until late January so there is no earnings risk in the Dec 18 expiration date. In fact, even if we go out to the Jan 15 expiration date, there is no earnings risk. Plus you will capture a dividend with WDC and ABBV:

As always, do your own research to determine if these stocks are right for your portfolio. The only thing we know for certain is that Jeffries currently likes these companies.

|

| AAPL And 3 Other Covered Calls For Dec 18 Expiration |

|

With about 2.5 weeks to go until the December options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 120 |

| 2. | P | 12 |

| 3. | GE | 31 |

| 4. | AAL | 40 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | FB |

| 4. | T |

| 5. | VZ |

| 6. | XOM |

| 7. | INTC |

| 8. | JNJ |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|