| AAPL in 2016 |

|

Looking back on past issues of Seller's Paradise we noticed that only one stock was in the list of top 4 covered calls every month in 2015: AAPL. Not surprising, as it is the largest company on earth ($586B current market cap), has a history of growth, and pays about a 2% annual dividend.

So, for 2016 we are going to track four AAPL investment strategies that use weekly covered calls. They are: (1) 12% annual return goal, (2) 24% annual return goal, (3) ATM, and (4) 2% OTM. For each strategy we will pick a strike that is most closely aligned with the strategy each week, intending to sell 52 weekly covered calls in 2016. Dividends will be included in the return numbers.

For full details, and to track the trades during the year, check out Apple Strategy For Investing in 2016.

|

| 2016 Predictions For S&P 500 |

|

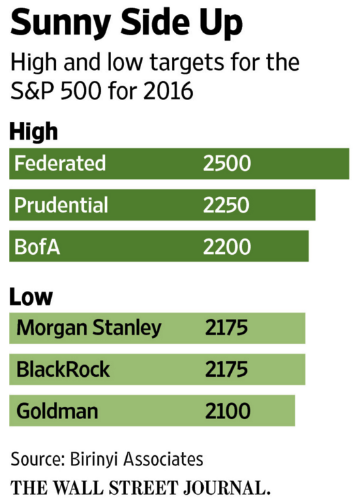

The S&P 500 index finished 2015 at 2043.94. The predictions for 2016 have come in with the highest being 2500 (whoo hoo!) and the lowest coming in at 2100 (Goldman Sachs), which is still a small gain for the year. The top 3 and bottom 3 forecasts are:

However, take this with a grain of salt. Since 2000, the S&P 500 has returned a 4% average annual gain, excluding dividends. By comparison, Wall Street strategists have predicted 10% yearly returns. And, on average, the consensus always has predicted annual gains, missing all five down years in that stretch.

|

| US Debt Ceiling |

|

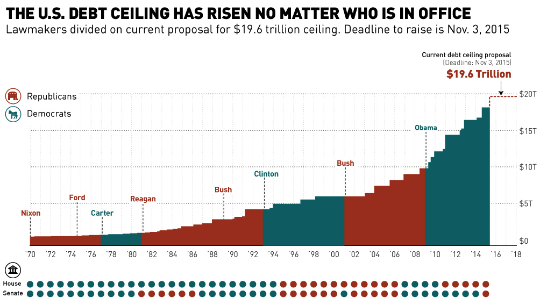

Congressional deadlock, unyielding partisanship, and non-stop bickering are good for no one. These tactics typically result in lose-lose outcomes that hurt everyone. Cutting the deficit (and debt) is hard and, for electability reasons, today's politicians are unable to create any budget that results in some set of registered voters ending up as "losers". No matter who is in office the debt keeps getting worse:

Another sobering web page tracks the US debt real-time: US Debt Clock. We're not sure how the US government is ever going to pay back $19 trillion but we do wish they'd get on with it already. Currently the US is responsible for 29% of the $60T global debt. Yikes.

|

| All The Money In The World |

|

How much money exists in the world?

Last month the Money Project created a data visualization of the world's total money supply, comparing the different definitions of money. It contains recognizable benchmarks such as the wealth of the richest people in the world, the market capitalizations of the largest publicly-traded companies, the value of all stock markets, and the total of all global debt.

The end result is a hierarchy of information that ranges from some of the smallest markets (Bitcoin = $5 billion, Silver above-ground stock = $14 billion) to the world's largest markets (Derivatives on a notional contract basis = somewhere in the range of $630 trillion to $1.2 quadrillion).

In between those benchmarks is the total of the world's money, depending on how it is defined. This includes the global supply of all coinage and banknotes ($5 trillion), the above-ground gold supply ($7.8 trillion), the narrow money supply ($28.6 trillion), and the broad money supply ($80.9 trillion).

Check out the graphic; it's well done.

|

| AAPL And 3 Other Covered Calls For Jan 15 Expiration |

|

With about 2 weeks to go until the January options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 110 |

| 2. | T | 37 |

| 3. | CVX | 115 |

| 4. | AAL | 43.5 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | FB |

| 4. | VZ |

| 5. | INTC |

| 6. | T |

| 7. | XOM |

| 8. | JNJ |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|