| Interviews With Seasoned Covered Call Professionals |

|

This month we interviewed two full time professional money managers who use the covered call strategy almost exclusively.

First is Scott Kyle of Coastwise Capital Group in San Diego, CA. Scott has been investing with covered calls for 20 years. He likes high quality dividend payers and generally sells options 1 to 4 months out. He's targeting 2x to 2.5x the dividend yield in call premium. For more stats an strategy tips on how he uses covered calls please read Coastwise Capital Group Interview. First is Scott Kyle of Coastwise Capital Group in San Diego, CA. Scott has been investing with covered calls for 20 years. He likes high quality dividend payers and generally sells options 1 to 4 months out. He's targeting 2x to 2.5x the dividend yield in call premium. For more stats an strategy tips on how he uses covered calls please read Coastwise Capital Group Interview.

Second is Kevin Simpson of Capital Wealth Planning in Naples, FL. Kevin uses his 20+ years experience to manage over $300M in covered calls. What's a little different is that he does it all with ETFs. Typically has 10-12 ETF positions, targets a 2% dividend yield, and 3% or more in call premium yield. He's also not afraid to write a below-cost-basis strike on ETFs that have gone down since he bought them. Read the full story on his strategy in the Capital Wealth Planning Interview. Second is Kevin Simpson of Capital Wealth Planning in Naples, FL. Kevin uses his 20+ years experience to manage over $300M in covered calls. What's a little different is that he does it all with ETFs. Typically has 10-12 ETF positions, targets a 2% dividend yield, and 3% or more in call premium yield. He's also not afraid to write a below-cost-basis strike on ETFs that have gone down since he bought them. Read the full story on his strategy in the Capital Wealth Planning Interview.

|

| AAPL Weekly Trades And A Ratio Spread |

|

Last week's AAPL earnings were good but stock action was poor. If you read the press or listen to the downgrading analysts you'd think Apple was on the verge of being delisted. Ugh.

We had 4 weeks worth of weekly covered calls on AAPL expire out of the money in January. The good news is that we collected 64 to 78 points of call premium since we initiated the trade on Dec 5th. But that wasn't enough to protect us from the big drop after earnings last week.

As stated in the Jan 29 update to this trade, we are sitting tight for now instead of writing underwater strikes against our position (because we have a bullish bias for AAPL and believe it will rise above 450 soon). We reviewed several stock repair strategies and suggested a ratio spread for those who want to lower their break even point and get out of the trade sooner. Read all about it in the AAPL Weekly Trade update from Jan 29.

|

| Will You Be Assigned? |

|

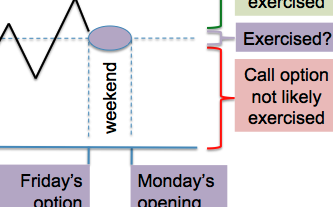

On expiration Friday it's often hard to know if your covered call will be called away or not if the stock price is hovering right around the strike price. So how does it work? Who determines if you will be called or not? What are the conditions under which they would exercise? On expiration Friday it's often hard to know if your covered call will be called away or not if the stock price is hovering right around the strike price. So how does it work? Who determines if you will be called or not? What are the conditions under which they would exercise?

Our blog article, Will I Be Assigned?, explains that not all options of the same strike will necessarily be exercised (or not exercised). It's up to the option holders and their beliefs about the underlying's opening price on the next trading day (Monday morning). Check it out.

|

| Free Tips On Covered Calls |

|

Born To Sell is in the process of getting our social on. We need your help, and in return promise lots of great covered call content (for free).

There are 8 easy ways you can help us while at the same time keep yourself informed of valuable new covered call content (strategy tips, trade ideas, interviews with professionals, etc). Login to your social accounts and:

- Go to Born To Sell's LinkedIn page and follow us.

- Go to Mike Scanlin's LinkedIn page (author of the covered call content on the Born To Sell site) and endorse him for "Covered Calls" (scroll to the Skills section and click the Covered Calls skill).

- Go to Mike Scanlin's SeekingAlpha page and follow him.

- Go to Born To Sell's Twitter page and follow us.

- Go to Born To Sell's Facebook page and Like us.

- Go to Born To Sell and click the +1 and Like buttons in the footer.

- Forward this email to a friend

It only takes a minute and we'd really appreciate it. Thanks!

|

| GMCR And 3 Other Covered Calls For Feb 16 Expiration |

|

With 2 weeks to go until the February options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | GMCR | 40 |

| 2. | AAPL | 455 |

| 3. | RIMM | 14 |

| 4. | INTC | 21 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | INTC |

| 4. | T |

| 5. | CSCO |

| 6. | MCD |

| 7. | GE |

| 8. | JNJ |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|