6 Ways To Do Stock Repair

If you were long any stocks between mid-July to mid-August, 2011, then you most likely experienced some of this pain:

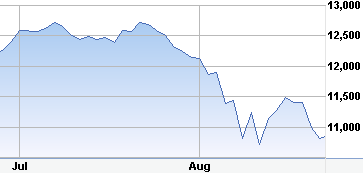

Dow Jones INDU, July to mid August, 2011

Ouch! Nothing like a 2000 point drop in the Dow in a few short weeks to get your attention. Assuming you didn't panic sell you are still holding stocks that are probably below your cost. Here are some ways to repair your stocks.

What To Do When Things Go Wrong

One question we get asked a lot is: What do I do if the stock I bought for the purpose of writing call options falls in value below my break even point? Do I sell the stock? Do I write a call with a strike price below my break even point? Something else?

Well, it depends. There are a few ways to think about it:

- Are the reasons you purchased the stock in the first place still valid? Are you comfortable with the company's prospects for the next year or more? If so, keep the stock and think about how to optimize income and upside potential by writing short-term out-of-the-money options as often as possible.

- Is there another investment you like better than the fallen one you now own? If so, you may want to switch to the new investment. You don't want to do this too often, though. There are transaction costs and could be tax consequences. Plus, investing is a game of patience where you need to give your investment choices time to work out.

- Are your position sizes and diversification still within normal bounds after one or more positions have made significant moves? If not, then maybe time to make an adjustment (could be a partial adjustment, no need to get radical).

- You just want to get back to even (or minimize future losses) and are interested in some kind of stock repair for a given position.

6 Stock Repair / Recovery Choices

- Sell the stock. Cut your losses and move on. This is the only option that removes future downside risk.

- Buy puts. This will let you sleep at night but can be expensive (and you maybe should have bought the puts before the position crashed...).

- Do nothing. Wait for the stock to recover a bit before writing any more options against it. Patience.

- Sell new covered options with enough time premium so that if called you will get back to break even or better. You want to sell an option so that the strike + option premium is greater than your current cost basis. This can be risky if the option you are selling expires after the next earnings announcement, so be aware of that.

- Buy more stock. This is the 'average your price down' strategy. If you liked it at $20/share you must love it at $10/share, right? Double down to lower your cost to $15/share. There are mixed opinions on this strategy among pros, but everyone admits it is widely used. As long as the reasons why the stock went from $20 to $10 are recoverable you could do okay with this strategy, although it does require more capital and increases your risk to the company. For call writers, you can buy more stock to lower your basis and then write calls on the whole lot (at a new, lower strike now that your basis is lower) so that if called the overall position will make money. But be careful with this -- you don't want to throw good money after bad if the company has turned into a permanent loser.

- Traditional options-based stock repair. This zero-cost strategy lowers your cost and increases your odds of breaking even but has the downside that the best you can do is break even and it leaves you exposed to further downside movement. It involves a ratio call spread with a cost of zero (or near zero). Say you owned 100 shares with an adjusted cost basis of 50 and the stock is now trading at 40. You could buy 1 call with a strike of 40, and then sell 2 calls with a strike of 45 (all 3 with the same expiration date). The goal is to receive 1/2 the cost of the 40 strike for each of the two 45 strikes you sold so that the net cost to you for the spread is zero (i.e. maybe you pay $200 for the 40 strike you bought but you receive $100 for each of the 45 strikes you sold, so a net cost of zero). If the stock recovers half way (to 45) by expiration then you break even on your original investment. If the stock shoots up to anything over 45 then you also only break even. If the stock is below 45 at expiration then you may make or lose a little and can do it again the following month.

Because stocks are so liquid it can be difficult to be disciplined about giving them enough time. With just a click of the mouse you can be back to cash or buy some other stock you like better. But it's difficult to time the market and you risk being whipsawed. Nothing hurts more than watching the thing you just sold at a loss shoot back up into what would be profitable territory for you. Sometimes the best repair strategy is a bit of patience and after the stock has recovered a bit then sell a new covered call on it at a strike that will result in a profit if called.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.