| 25 Years Of At-The-Money Buy-Writes Beats Market |

|

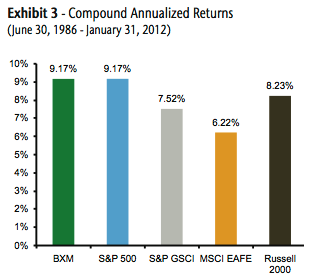

Hewitt EnnisKnupp, an investment consulting company, did an analysis of 25 years of buy-write index option writing (i.e. covered calls) from 1986 to 2012. Hewitt EnnisKnupp, an investment consulting company, did an analysis of 25 years of buy-write index option writing (i.e. covered calls) from 1986 to 2012.

The results show that the strategy of writing 1-month at-the-money covered calls on the S&P 500 lowers portfolio volatility and meets or exceeds returns of comparable indices.

The report shows returns per month and standard deviations (i.e. volatility) over time, and mentions how the strategy works in rising, sideways, and down markets, among other commentary and data. To read the full report, see BXM Performance Review.

|

| Best Covered Call Discussion Group |

|

We read lots of investment blogs and discussion forums. By far, the best one for covered call investors is the Yahoo group Just Covered Calls. It has been around for years and has over 2300 members. We read lots of investment blogs and discussion forums. By far, the best one for covered call investors is the Yahoo group Just Covered Calls. It has been around for years and has over 2300 members.

It's free to join and participate, is professionally moderated by a couple of active covered call investors, and is a clean, well lit place for you to get covered call trade ideas and ask covered call questions (they also discuss naked puts, an equivalent trade).

For more information, visit our review of the Just Covered Calls forum.

|

| Top 10 Ways To Lose Money With Covered Calls |

|

Are you making too much money with your covered calls? Don't worry; you're not alone. It happens. Are you making too much money with your covered calls? Don't worry; you're not alone. It happens.

Do you wish there was a way you could give back some of your profits so other people can have some?

No sweat! We've put together a Top 10 List on How To Lose Money With Covered Calls (and, interestingly, if you're *not* making more money than you know what to do with using covered calls, then you may want to check out the list and see if any of your covered call strategies are on it...).

From the list, here are a couple of ways to lose money:

- 1. Aggressive Position Sizes

- 2. Lots Of Margin

- 3. Selling Fat Premiums Without Knowing Why They're Fat

- 4. ... and more ...

For the complete list of money-losing habits, see our blog article on Top 10 Ways To Lose Money With Covered Calls.

|

| TIVO And 3 Other Covered Calls For Jun 22 Expiration |

|

With 3 weeks to go until the June options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | TIVO | 13 |

| 2. | BBRY | 15 |

| 3. | SPWR | 21 |

| 4. | SNTA | 7.5 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | INTC |

| 4. | T |

| 5. | GE |

| 6. | CSCO |

| 7. | MCD |

| 8. | BAC |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|