| Goldman Likes Covered Index Writing |

|

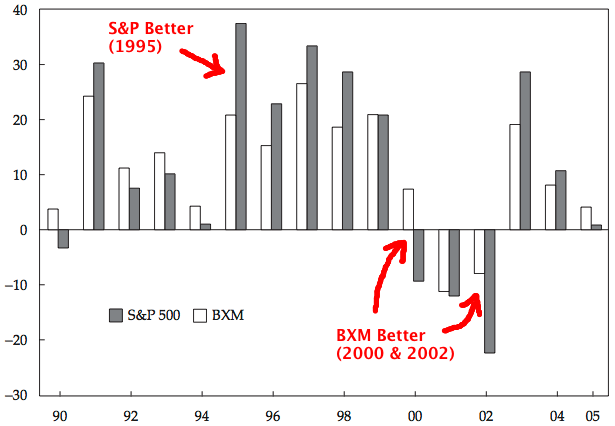

After an analysis of 15 years of buy-write index call writing, Goldman Sachs found that the strategy of writing covered calls on the S&P 500, when compared to simply buying and holding the S&P 500, increased returns and lowered portfolio volatility (similar results to several other covered call studies). After an analysis of 15 years of buy-write index call writing, Goldman Sachs found that the strategy of writing covered calls on the S&P 500, when compared to simply buying and holding the S&P 500, increased returns and lowered portfolio volatility (similar results to several other covered call studies).

Not only did Goldman show how the BXM (buy-write index) beat the S&P over 15 years, they also showed 3 other buy-write strategies that beat the BXM itself, including a better at-the-money buy-write strategy, and two out-of-the-money buy-write strategies.

For details and to see the entire 46-page report, read Goldman Likes Covered Index Writing.

|

| LEAP Covered Calls |

|

Using LEAPs instead of shares of stock for covered writes has its pros and cons. On the plus side, it requires less capital and has smaller downside potential than owning stock.

However, there are several negatives to using LEAPs that you need to consider: (1) you don't get any dividends, (2) early exercise can ruin the trade, (3) a drop in volatility can ruin the trade, (4) a stock drop can cause you to run out of time and ruin the trade, (5) bid-ask spreads can be large if you need to exit early, etc.

For conservative investors who like simplicity, we recommend covered calls with shares of stock instead of LEAPs. Read more about our reasoning in our blog article Use LEAPs for Covered Writes?

|

| Syria Portfolio Protection |

|

If the US military bombs Syria stocks are likely to go down. How long they stay down depends on whether or not this is a short bombing campaign or if it turns into a broader, longer conflict. During prior conflicts it has taken between 40 and 795 days for the market to return where it was before the military action started.

We posted a blog on Aug 26 suggesting that you increase your cash position. Given the 170 point drop the next day, our timing was good. For more thoughts, including a list of prior conflicts and how long the market took to return to pre-conflict levels, and a list of potential covered calls that could do well during a military strike, please read Syrian Portfolio Protection.

|

| Replay of Born To Sell's MoneyShow Webcast |

|

For the hundreds who came out to see our CEO present in San Francisco on Aug 15, thank you. For the hundreds who came out to see our CEO present in San Francisco on Aug 15, thank you.

|

| AAPL And 3 Other Covered Calls For Sep 21 Expiration |

|

With 3 weeks to go until the September options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 505 |

| 2. | NBIX | 15 |

| 3. | WLT | 12.5 |

| 4. | FCX | 31 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| MSFT And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | MSFT |

| 2. | AAPL |

| 3. | INTC |

| 4. | T |

| 5. | KO |

| 6. | BAC |

| 7. | CSCO |

| 8. | JNJ |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|