| Covered Calls for 2014: Keep the Income Coming |

|

Minyanville published a nice piece by Steve Smith recently talking about the 2nd half of 2013 being disappointing (compared to the 1st half), mostly because of Fed tapering (or anticipation of tapering). He suggests out of the money covered calls to keep the income coming in 2014 as more tapering takes place. Read Covered Calls for 2014: Keep the Income Coming.

|

| Buy Covered Calls When It Snows |

|

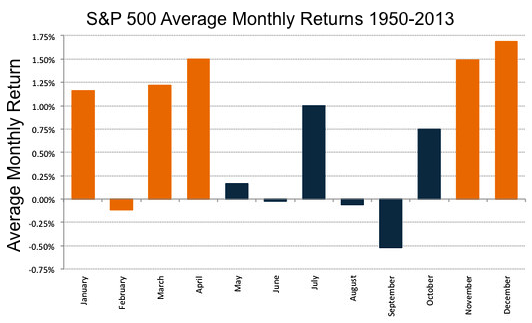

A couple of researchers at Massey University in New Zealand recently did a study showing that market returns were 6.25% higher November thru April when compared with May thru October (over the last 50 years), thus lending credence to the adage "buy when it snows, sell when it goes."

The article discusses covered calls and ETFs, and sums it up with:

"Covered call strategies are one way for investors to maintain a core equity position in the S&P 500 while potentially taking advantage of any heightened volatility in the stocks of the underlying index. While the strategy does not protect from large price declines, it can potentially generate additional income to offset declines.

Accordingly, investors who buy a covered call strategy when it snows may benefit from its structure when it goes."

Read the original article at This ETF strategy covers you in stormy markets.

|

| Dividend Champions About To Increase Dividends |

|

Dividend Champions are those companies that have raised their dividends for 25 years in a row or more. Based on their long track record of increasing dividends, it is often possible to estimate when they will do so next. In many cases you can buy the stocks now, before they announce the increase, and write a covered call against them.

In our article Dividend Champions Covered Calls we examine a few candidates.

|

| Free Born To Sell Subscriptions |

|

We're giving away 5 subscriptions to Born To Sell and today (Feb 1) is the last chance you have to enter. Two ways to win: (1) You can be good or (2) you can be lucky. We're giving away 5 subscriptions to Born To Sell and today (Feb 1) is the last chance you have to enter. Two ways to win: (1) You can be good or (2) you can be lucky.

For the "good" part, all you have to do is enter a guess for the closing value of the Dow Jones Industrial Average on option expiration day (Feb 21). Closest guess wins a 3-month subscription to Born To Sell.

For the "lucky" part, we're also giving away 4 subscriptions in a random drawing from all the entries we receive.

It only take seconds to enter. Check out the Guess The Dow contest.

|

| Tom Sullivan Loves Covered Calls |

|

Tom Sullivan hosts a daily radio show called "The Tom Sullivan Show" that has been consistently rated #1 in its time slot since 1998. He has worked in the financial industry for 30 years.

In this 4 minute video clip he makes three points: (1) most people over 55 have no savings, (2) a safe rate of withdrawal from retirement funds (so you don't outlive your money) is 4% per year, and (3) he loves covered calls as an investment strategy.

Start at minute 2:06 if you want to see what he says about covered calls:

|

Trader Status For Covered Call Investors

(reprint due to proximity of tax filing season) |

|

For tax purposes, achieving "trader" status with the IRS has several advantages. You can deduct margin interest, investment seminar expenses, home office expenses, and more... and none of it is subject to the 2% rule for deductions. Furthermore, you are not limited to the $3K/year capital loss rule.

However, saying you are a 'trader' and having the IRS agree you are a 'trader' can be two different things.

Do you think a guy who traded 1543 trades in a year would be a 'trader'? The IRS said 'no'. See our article Trader Status For Covered Call Investors for tips and examples of what is and is not (in the eyes of the IRS) legitimate trader status.

|

| NQ And 3 Other Covered Calls For Feb 21 Expiration |

|

With 3 weeks to go until the February options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | NQ | 17 |

| 2. | TWTR | 60 |

| 3. | MSFT | 37 |

| 4. | MU | 23 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | T |

| 4. | INTC |

| 5. | MCD |

| 6. | JNJ |

| 7. | CSCO |

| 8. | KO |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|