Dividend Champions Covered Calls Jan 2014

Dividend Champions are those companies that have raised their dividends for 25 years in a row or more.

Given their long history of increasing dividends, it is likely they will continue to do so. If you could predict when they would next increase their dividends, you could buy some shares and write covered calls in advance of that (taking advantage of the fact that the market usually reacts positively to a company announcing an increase to its dividend).

David Fish of Moneypaper recently wrote These 23 Dividend Champions Could Soon Boost Payouts where he points out that the majority of champions have a habit of announcing dividend increases about the same time each year. Normally the announcements come between 2 days and 2 months before the ex-dividend date. He claims that 90% of the time these dividend increases can be predicted.

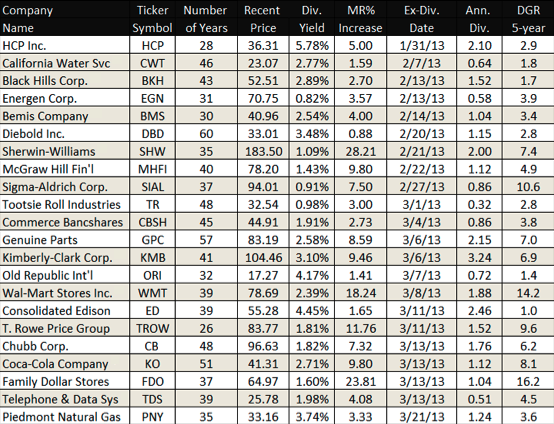

Companies On Deck For A Near-Term Dividend Increase

David identified 23 companies that are within the window of "about to increase their dividend" based on past behavior and last year's dates. 22 of the 23 have options available, which are:

(column headings: Number of Years = consecutive years of higher dividends, MR = Most Recent, DGR = Dividend Growth Rate)

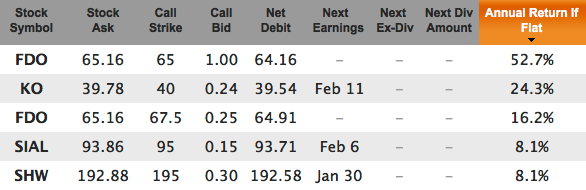

Dividend Champions With Covered Calls

If you take those 22 symbols and plug them into Born To Sell's Watchlist feature, you find a couple candidates for short-term January covered calls that yield 1%/month or more on an annualized basis, and a couple that come close:

However, those expire Jan 18 and may not have enough time for the dividend increases to be announced. But you could do the Feb cycle and when the time premium is near zero (or just wait until after expiration) roll them to March.

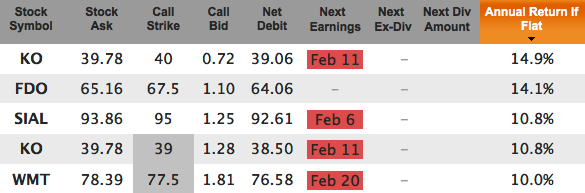

If you want to start with new trades today for the February 22 expiration date, you get:

Most of these have a scheduled earnings release date prior to the option expiration date, so if you don't want earnings volatility then stay away from covered calls that have a 'Next Earnings Date' in red.

If we go out to the March expiration there aren't any current opportunities from this set of 22 symbols that yield 10% or more in annualized return. Perhaps there will be if market volatility increases a bit.

Buy Stock Now, Write Calls Later

One final strategy with this list would be to buy any of the names you like, wait for the dividend increase to be announced, and *then* write a covered call against your shares. This kind of legging in to a covered call position can be smart if you expect good news about a stock (like a dividend increase) and it takes places as you anticipate.

Note: These are not trade recommendations. These are candidate trades with likely dividend increases coming. Do your own research, keep position sizes modest, and stay diversified.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.