| Six Ways To Repair An Underwater Stock Position |

|

The last part of July and first half of August were not fun (unless you were fortunate enough to be short). Many people own stocks that are now trading for less than what they paid for them (or, if they wrote calls against them, trading for less than their adjusted cost basis). There are a few ways to handle this situation:

- Sell the stock. Eliminate the risk of additional losses.

- Buy puts. Keep the stock and sleep at night.

- Do nothing. Wait for the stock to rebound.

- Sell covered calls at a strike that results in a profit if called. Might need to go out a few months to get enough premium.

- Buy more stock. Average down your basis, and then sell covered calls with a strike near your new lower basis. Increases your exposure to the stock, though.

- Zero cost ratio call spread. For each 100 shares, buy 1 call and sell 2 other calls at a higher strike. You won't make a killing but the cost of this repair strategy can be zero (no increased exposure to the stock) and will get you back to break even at a lower stock price than if you wait for it to go back to your adjusted basis.

We discuss all of these strategies in our blog entry on stock repair.

|

| Living On Investment Yield |

|

Fixed income investors rely on interest income to pay for their monthly expenses. They have a tough time when interest rates are at historic lows. Cash pays next to nothing (treasuries aren't much better) and the near term looks like more of the same. AAA rated municipal bonds only pay 1.8% for 5 years, or 3.2% for 10 years. A paltry sum and it can be depressing to lock in such a low rate for 10 years.

With the S&P trading at a relatively low P/E ratio, and dividends on blue chip stocks paying relatively well, a good alternative to bonds or cash is to buy blue-chip stocks with good dividends and write covered calls on them. If you want to reduce your equity risk then write deep in the money calls. It's not get-rich-quick, but the yield is significantly higher than bonds or cash.

We discussed this strategy using Dividend Champions in our blog article on How To Double Treasury Rates.

|

| Successful Income Investing |

|

The most important point when developing an investment plan where the focus is on income is to put together a set of assets that generate the highest possible income with the lowest possible risk. Income producing assets can include stocks (dividends), bonds (interest), real estate (rent), and other assets (limited partnerships) that produce income.

For considerations on using call options for income, varying your time horizon, equity risk, and diversification, see our blog article on Successful Income Investing.

|

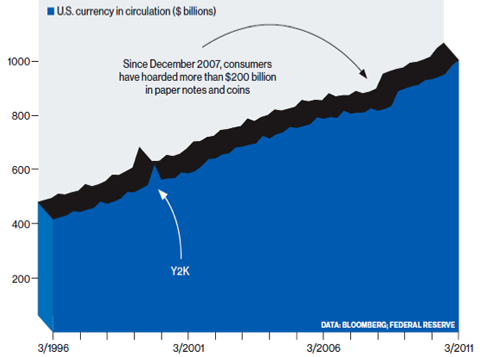

| How Much US Currency Is In Circulation? |

|

As of August 10, 2011, there is $1.03 trillion in circulation, of which $992 billion is paper money and $38 billion is coins. If you haven't seen it, check out our visual description on How Much Is A Trillion Dollars?

|

| |

| T And 3 Other Covered Calls For Sep 17 Expiration |

|

With just over 2 weeks to go until the Sep options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | T | 30 |

| 2. | MSFT | 26 |

| 3. | AAPL | 360 |

| 4. | JNJ | 65 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks and ETFs |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | INTC |

| 3. | MSFT |

| 4. | T |

| 5. | JNJ |

| 6. | GE |

| 7. | F |

| 8. | SPY |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|