High Yield Covered Calls

Searching for high yield covered calls is a common activity among yield-oriented investors. Covered calls can be a conservative alternative to other high yield investments, although one must be careful not to just chase yield without regard to risk. There's usually something going on with the underlying stock to make the premiums so high.

One factor that drives yield is moneyness, or the relationship between the current stock price and the option's strike price. For any given underlying stock, the at-the-money (ATM) options usually provide the highest return-if-flat yield (meaning the return you will receive if the underlying stock stays flat, or unchanged, between today and expiration), while in-the-money (ITM) and out-of-the-money (OTM) offer less yield.

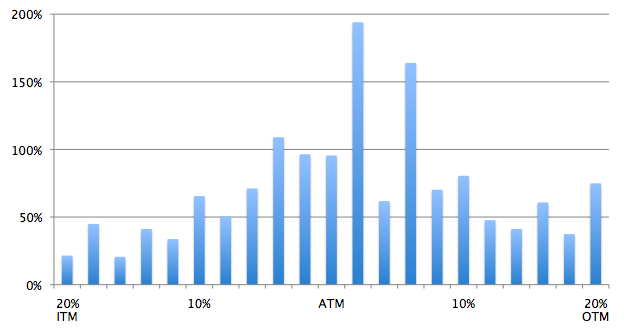

To illustrate this with today's market data, we used our screener to find the highest yielding covered call for Dec 2010 (6 weeks to expiration) at each level of moneyness, from 20% ITM to 20% OTM, and then plotted that option's annualized return-if-flat. We also removed anything that had a scheduled earnings release prior to expiration, so these high premiums are not earnings driven:

Annualized Return-If-Flat for High Yield Covered Calls

On the left side of the graph are ITM values from 20% to 1%, meaning the strike price is between 20% and 1% in-the-money. Likewise, the right half of the chart shows OTM values, from 1% OTM to 20% OTM. And right in the center is the highest yielding at-the-money covered call for today.

The data is not perfectly smooth but you can see that in general the middle values are higher than at the ends, which shows that covered calls closer to ATM are normally higher yielding than ones that are deep ITM or deep OTM.

It's also interesting that at almost every level of moneyness you can find a covered call with an annualized yield of 40% or higher.

What kind of company makes it to the high yield covered calls list?

Here are a few examples (these are all for Dec 18, 2010 expiration):

Clearly these are some volatile names. Each has a story as to why the premiums are so high, and before you invest in something that pays an unusually high yield you should be sure you understand what's driving the premiums (and you can check the annualized return math with the covered calls calculator).

Finding high yield covered calls is easy when you have a good screener (sign up for Born To Sell's 2 week free trial). But doing the research to understand why the premiums are so high is more work. Although usually you can figure out what's going on pretty quick at any financial news site that let's you filter the news by ticker symbol (a quick check at Yahoo Finance showed that HGSI is awaiting the results of an FDA meeting, for example).

Looking for high yield covered calls? Check Out Our Covered Call Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.