| 63 Out Of 65 Weeks Profitable With Covered Calls |

|

Chris Ebert of ZenTrader recently pointed out that in 63 of the past 65 weeks it has been profitable to write at-the-money, 4-month duration covered calls on SPY (S&P 500 ETF). Each trade returned at least 4% over 4 months, giving this strategy an annualized return of more than 12%. An impressive track record for a simple strategy. Read the full article Zen And The Art Of Covered Call Trading.

|

| Mini Options Are Coming In March! |

|

Starting on March 18 some of the more expensive stocks will begin trading "mini" options. They're identical to regular options except they only control 10 shares instead of 100. Now you can write covered calls on AAPL, GOOG, PCLN, etc, by owning only 10 shares. Read more about the new minis in Mini Options Are Coming.

|

| Time Premium In Options |

|

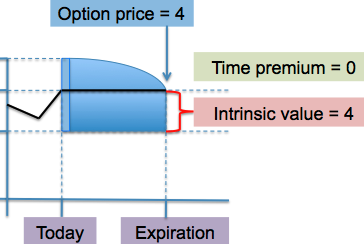

As promised in last month's Will I Be Assigned? article, we are now looking at how time premium is calculated. As promised in last month's Will I Be Assigned? article, we are now looking at how time premium is calculated.

The new article, Time Premium In Options, explains how an option's price is made up of two components: time premium and intrinsic value. It discusses how to calculate each, which is not totally obvious considering there are at least 6 values you could use: stock bid, stock ask, stock last trade, call bid, call ask, and call last trade. Your choice will definitely affect your return calculation so you want to use accurate values. See what we have to say about time premium and return calculations.

|

| New Video: Covered Call Tutorial |

|

In an effort to explain covered calls to investors who may not be familiar with them, we created a new 2 minute video called Quick Covered Call Tutorial. In an effort to explain covered calls to investors who may not be familiar with them, we created a new 2 minute video called Quick Covered Call Tutorial.

Hopefully beginners will find it to be as clean and simple as we intended. If you want more examples, there is always the tutorial on our site.

|

| Options Volume Up 7.7% |

|

In early February the Options Industry Council announced that in the prior month there was a 7.7% increase in option volume compared to the same period a year ago.

We compiled a list of the highest volume options for equities and ETFs. Top three option volume stocks were AAPL, INTC, and FB, while the top 3 option volume ETFs were SPY, IWM and QQQ. For the complete list of top 20 stocks and top 19 ETFs, see our article on Most Liquid Options.

|

| AAPL And 3 Other Covered Calls For Mar 16 Expiration |

|

With 2 weeks to go until the March options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 450 |

| 2. | MSFT | 29 |

| 3. | BBRY | 13 |

| 4. | SLW | 32 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| AAPL And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | INTC |

| 4. | T |

| 5. | GE |

| 6. | JNJ |

| 7. | MCD |

| 8. | BAC |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|