Time Premium In Options

An option's price is the sum of two parts: time premium and intrinsic value. Time premium is sometimes called "extrinsic value"; it means the same thing. Let's look at how we calculate these values.

option price = time premium + intrinsic value

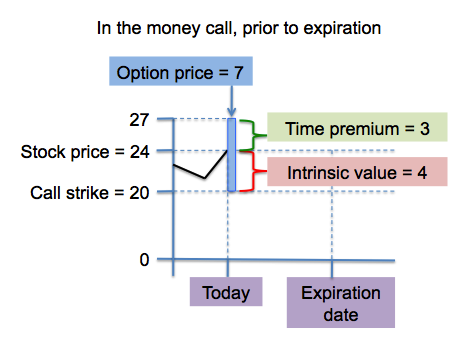

For in-the-money call (ITM) call options (where the call's strike is below the stock's current price), time premium is the option price minus the intrinsic value, where the intrinsic value is the difference between the call option's strike price and the stock's current price.

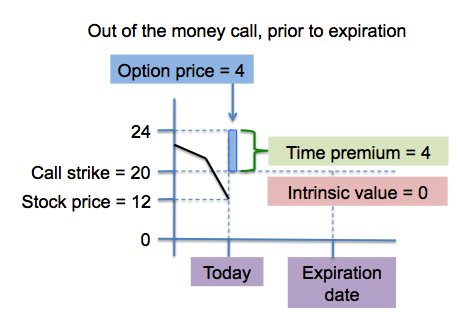

For out-of-the-money (OTM) call options (where the call's strike is above the stock's current price), time premium is equal to the option's price (since intrinsic value = 0 for out of the money options).

Here's a chart of a stock with a current price of $12 and a 20-strike call option with a price of 4. The option is OTM (out of the money) because the strike (20) is above the current stock price (12). There is no intrinsic value in this option. The option is currently selling for 4, so the time premium is 4:

Now let's look at an ITM situation. The stock's current price is 24, the call option's strike is 20, and the option is currently selling for 7. We calculate the intrinsic value as the difference between the stock price (24) and strike price (20), and get 4. The time premium is the difference between the option's price (7) and the intrinsic value (4), or 3:

What happens to time premium as time passes?

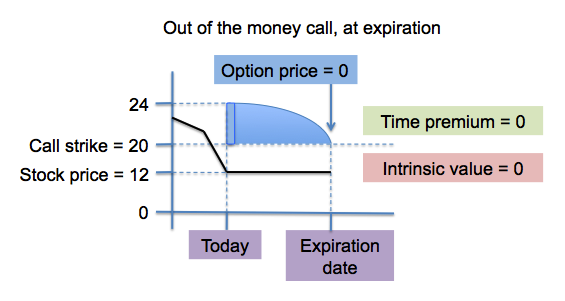

The short answer is that time premium goes down ("decays") as time passes, so the option loses value.

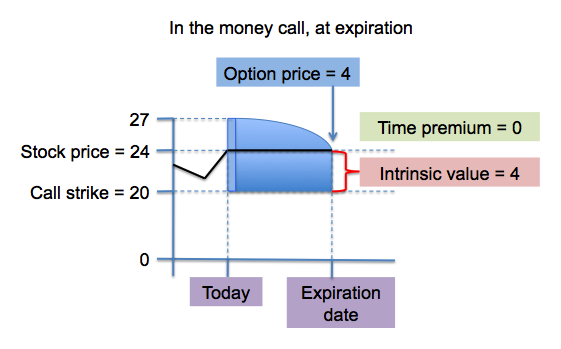

However, it does not do so in a straight line fashion. Time premium decay accelerates as the expiration date gets nearer. On expiration day, the time premium is zero since there is no time left.

For the OTM case, it looks like this. Note that the option's price (and, therefore, time premium) falls over time as the stock price remains the same:

For the ITM case, it's the same kind of time decay, except that intrinsic value does not decay. The option still has value at expiration because it is in-the-money. The holder of this call option could sell it for 4 when it expires (because the stock is 4 points higher than the strike price), or he could exercise it and acquire stock for 20 (when it's selling for 24):

Now, in the real world it's a little more complicated...

Unfortunately, it's not that simple. In the real world there is not just one price for an option or a stock. Both have a bid price and an ask price (and a last trade price, which could be different than the current bid or ask). So which do you use?

For purposes of showing buy-write candidates, we have chosen to use a stock's asking price and a call option's bid price. The reasoning is this: (1) we only want to show a trade you could execute in the real world, and (2) if you were to place a market order to buy the stock and sell the call then you would pay the stock's asking price and you would receive the call's bid price.

So, the math on the Born To Sell site works like this:

- intrinsic_value = stock_ask - call_strike (or, for out of the money options where stock_ask > call_strike, we set intrinsic_value to zero)

- time_premium = call_bid - intrinsic_value

Different numbers on other sites...

Because there are choices on what value to use for "stock price" or "call price" you may see different values on different sites for an option's current time premium or intrinsic value. We have chosen the most conservative approach, and only show values you can achieve in the real world with market orders when entering a new buy-write transaction.

Why does it matter?

Time premium is one of the factors used in calculating returns for covered call trades. By choosing a conservative value for time premium, Born To Sell is showing you conservative values for the return calculations it performs. Using a higher value for time premium, which you might get if you used last_trade for the stock price and the call price, could result in higher but impossible-to-realize returns. And that doesn't benefit anyone.

Find good time premium fast: Check out our Covered Call Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.