Covered Call Returns And Profits

The profits you make in covered call investments come from three sources:

- Time premium decay of the call option you've sold.

- For out-of-the-money covered calls, any increase in the underlying stock price during the time you held the position (at-the-money and in-the-money options don't have any upside potential).

- Dividends that went ex-dividend during the time you held the position.

However, before we examine those, let's look at the profit for a typical buy and hold investment.

Buy And Hold Profit And Loss

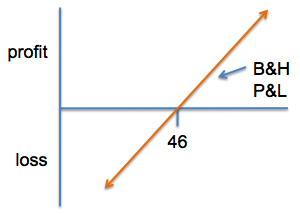

Imagine you bought 100 shares of stock for $46/share. The profit and loss graph for a buy and hold strategy with this stock looks like this (note on chart abbreviations: B&H = Buy And Hold; P&L = Profit & Loss):

The horizontal axis is the stock price and the vertical axis is your profit or loss. As the stock price increases, the profit goes up. Likewise, at prices below 46 we enter into loss territory. It's a simple linear profit and loss outcome.

Covered Call Profit And Loss

Covered calls are a little different because the most you can ever sell your stock for is the strike price per share. If the stock was higher than the strike price at expiration then the person who bought your call option will exercise it (i.e. take your stock and pay you the strike price per share in cash). That's why there is a cap on your upside when trading covered calls.

The benefit of having sold the call option, though, is that you've lowered your break even price by the amount you received for the option.

Profit Example For A Covered Call

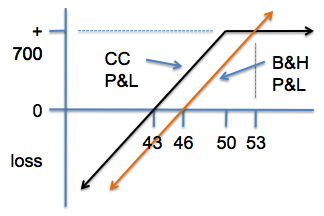

Let's take the same example as above where you buy 100 shares at $46/share. But now let's add on the sale of a 50-strike option for $3. The profit and loss graph for the covered call return is the black line on this graph:

The orange line is only there for comparison, so you can see how covered call returns compare to buy-and-hold returns. In this example, the covered call investor comes out ahead at all stock prices 53 or less (meaning the black line is above the orange line for all values on the x-axis that are 53 or less). Above 53 the buy-and-hold investor will make more money (where the orange line is above the black line). The most money that a covered call investor can make in this example is $700, and that happens at all stock prices 50 or greater (i.e. at the strike price or greater).

If the stock price was above 50 then the covered call investment would yield $4 profit on the stock (because we paid $46 and will receive $50 when the option is exercised) plus $3 on the option (since we sold the option for $3), for a total of $7/share (or $700 for 100 shares). Even if the stock goes to $60 or $70 we will only receive $50 for our shares.

For the downside case, the covered call investor shows a profit if the stock is $43 or higher when the option expires. The difference between our purchase price (46) and break even price (43) is the cash we received when we sold the option. At stock prices below 43 the covered call investor will have a loss, but the loss will always be $3/share less than the buy-and-hold investor.

Covered Call Returns From Dividends And Stock Increases

In the above example, the $3/share profit came from the time premium decay of the option we sold. It was worth $3 when we sold it but then on expiration day the option had $0 of time premium remaining. That was the first source of our profit.

The second source of profits in this example trade was the fact that the stock could end up higher than $46/share on expiration day. The covered call investor participates in the upside from 46 (purchase price) to 50 (strike price), but then stops gaining additional profits for every stock price above 50.

The third source of profits from covered call investments are dividends. As long as the ex-dividend date is between your purchase date and the option expiration date then you will receive the dividend (except in cases of early exercise). Of course, buy and hold investors receive the same dividends, so we have not included a dividend in the example above.

Long Term Covered Call Returns

Covered calls have proven they beat buy-and-hold investing for almost any time frame during the last 25 years. When you are done reading this tutorial, we have several Covered Call Returns Studies that prove the point.