Option Exercise Is Good For You!

In the physical world, exercise involves sweat, pain, and sometimes tears. Well, we have those things in the option world, too. However "exercise" has a different meaning...

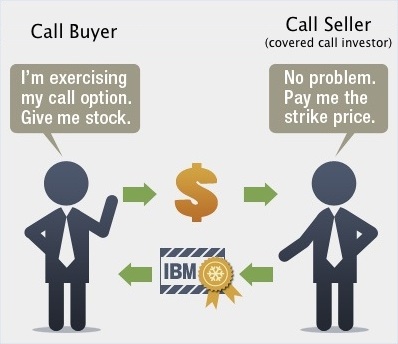

In the option world, the buyer of a call option (not you... as a covered call investor you are a seller of call options) has the right to buy your stock at a certain price (strike price) by a certain date (expiration date). When he decides he wants your stock at that price he will call his broker and exercise his right to force you to sell your stock to him at the strike price.

Options can be exercised by the option buyer at any time on or before their expiration date. The majority of options expire without being exercised at all. Of the ones that are exercised, almost all are exercised on their expiration date.

Sometimes an option is exercised before expiration, which is called early exercise. Early exercise sometimes happens if the underlying stock is about to pay a dividend (more on that in the ex-dividend section).

Option exercise is common when implementing a covered call strategy and is no big deal; it just means you receive cash for your stock, and now you can take that cash and go buy more stock (or you could party like a rockstar, or hire a personal fitness trainer; your choice).