Ex-Dividend Date

A stock's Ex-Dividend Date (also known as ex-div date or ex date) is the first day the stock trades without the dividend. In order to receive the dividend you must own the stock by the close of market on the day before the ex-dividend date.

On the morning of the ex date, the market makers will lower the price of the stock by the amount of the dividend that was just paid.

For example, if a stock has an ex-div date of March 5, you must own the stock by close of market on March 4 in order to receive the dividend.

If you sell your stock before the ex-div date then you will NOT receive the dividend. Likewise, if you buy the stock on the ex-div date you will NOT receive the dividend.

If you want to hold the stock for as little time as possible and still get the dividend, you can buy the stock just before the market closes the day before the ex-div date and then sell the stock just after the market opens on the ex-dividend date. You may make or lose a little on the stock, but you will get the dividend for sure.

Why Ex-Dividend Dates Matter To Covered Call Writers

Sometimes covered call writers will be subject to early exercise (meaning, the buyer of the option will exercise his right to purchase your stock before the option expiration date) just so they can capture the dividend. If this is going to happen then it usually happens to ITM options the day before the ex-dividend date. But normally it will only happen if the amount of time premium remaining in the option is zero or a few pennies.

Example: You own 100 shares of ABC stock, and it's currently trading at $51/share. You had previously sold a call option with a 40 strike, and that option is currently trading for $11 (at parity, no time premium remaining because it's 11 points ITM). ABC goes ex-dividend tomorrow and will pay a $0.50 dividend.

Will the option holder do an early exercise on you today?

Yes, because tomorrow morning (the ex-div date) the stock will open lower by the amount of dividend paid ($0.50), and deep ITM options will be lower by that same amount. In order to avoid a loss equal to the amount of the dividend, most deep ITM options with no (or very little) time premium remaining will be exercised.

If the option had more than a few pennies of time premium remaining then the option would probably not be exercised. Depending on the bid-ask spread for the option holder, as well as his commission rates, he would probably be better off just selling his option rather than exercising it.

And this is probably obvious but if a stock does not pay a dividend (and therefore has no ex-dividend date) then the odds of early exercise are practically zero (because the person doing the early exercise is giving up any remaining time premium -- he'd be better off just selling his option rather than exercising it).

Other Dividend Dates (Which You Can Ignore)

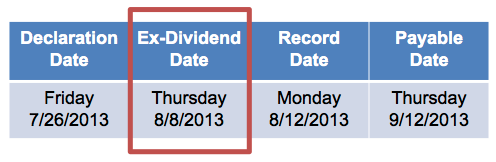

Although the ex-dividend date is the only date that matters to most investors, there are 3 other dates that relate to dividends: declaration date, record date, and payable date. Although important, all you need to focus on is the ex-div date. As long as you own the stock by the end of day on the day before the ex date then you will get paid the dividend (although you won't receive the money until the payable date).

The declaration date is the date the company declares the dividend (approves and announces it). This is just an informational date and can vary from days to weeks prior to the ex-dividend date. It only matters because a dividend isn't official until it is declared by the Board of Directors.

The record date is the date by which you need to be a shareholder of record in order to receive the dividend. It is normally 2 days after the ex-dividend date because it takes a couple of days for share transactions to settle. So you have to buy the stock before the ex date in order to have the transaction settle (i.e. be a shareholder of record) on the record date. Holidays come into play sometimes, too. But you can ignore all this and just focus on the ex date to know if you're going to get the dividend or not.

The payable date is the day you actually receive the cash from the dividend. It can be days to weeks after the record date. You can sell your stock before the payable date and still receive the dividend payment (as long as you own the stock the day before the ex-dividend date thru the morning of the ex date you will receive the dividend).