| Falling Market? Use In The Money Covered Calls |

|

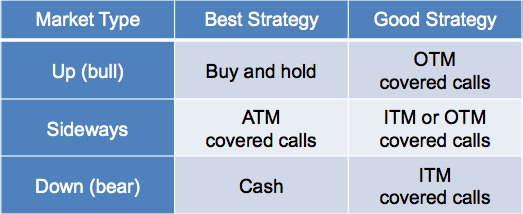

The last few days have been a good reminder that markets go down from time to time. During these times, your best strategies are (1) be in cash, or (2) use in-the-money (ITM) covered calls:

Deeper ITM strikes have more downside protection than at-the-money or out-of-the-money strikes. That protection comes at a price, of course -- there is no upside potential on the underlying stock with an ITM covered call. Your only source of profit is the time premium portion of the ITM covered call.

What about selling your stocks and just sit in cash? Not a bad strategy as long as the sale doesn't trigger a tax event you'd otherwise like to avoid. If your shares are in a tax-deferred account then no worries; if you want to sell then just sell so you can sleep at night. You can always buy back the shares when you're feeling more comfortable.

Another choice, and perhaps a good strategy during downward markets, is to write covered calls on inverse ETFs. They move opposite (inverse) to some other security. For example, symbol SH is the inverse of the S&P 500, RWM is the inverse of the Russell 2000, and DOG is the inverse of the Dow 30 stocks. Because SH is an inverse ETF, it goes up if the S&P 500 goes down. You can also write covered calls against your SH holding. For more info, review the article we published a year ago on Covered Calls on Inverse ETFs.

|

| Apple Weekly Option + Dividend Next Week |

|

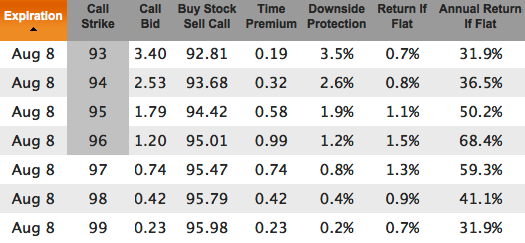

AAPL goes ex-dividend next week on Aug 7. That means you need to own the stock at the close on Aug 6 in order to get the 47 cent dividend. Because AAPL has weekly options available, next week provides an opportunity to earn both option premium and dividend income.

With AAPL closing a touch above 96, these AAPL weekly options have between 19 and 99 cents of time premium between today and next Friday:

The return calculations assume you will get the time premium plus the dividend (the "if flat" part means AAPL is "flat", or unchanged, between today and expiration). One thing to watch out for with this trade is early exercise. If there is zero time premium remaining in an in-the-money option at the close on Aug 6 (day before ex-div date) then the option holder (not the covered call writer, but the guy who the covered call writer sold the call option to) will take early exercise to capture the dividend (see Early Exercise Of Call Options).

To avoid early exercise, if you have zero time premium near the market close on the 6th, roll the option to a strike and expiration date combo that has positive time premium before the close.

|

| New $100K Challenge |

|

As a reminder, the most recent TraderMinute 4-month challenge, which ended about 10 days ago, resulted in a $46K gain from a $3K investment. As a reminder, the most recent TraderMinute 4-month challenge, which ended about 10 days ago, resulted in a $46K gain from a $3K investment.

Their next $100K Challenge has just started and you can use the Born To Sell discount code to get a free month trial to their Live Seat trading.

|

| AAPL And 3 Other Covered Calls For August 16 Expiration |

|

With about two weeks to go until the August options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 100 |

| 2. | MU | 34 |

| 3. | NQ | 5 |

| 4. | FB | 75 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| MSFT And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | AAPL |

| 2. | MSFT |

| 3. | INTC |

| 4. | T |

| 5. | FB |

| 6. | CSCO |

| 7. | MU |

| 8. | VZ |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|