Weekly Options Screener?

Weekly options are the same as monthly options except that they expire every Friday, not just on the Saturday after the 3rd Friday like monthly options.

Screening for Weekly Options

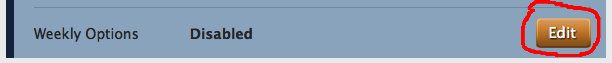

You can use Born To Sell to screen for weekly options, same as you do for monthly options. To screen weeklys, login and go to your Account page. Look for the Weekly Options preference and click the Edit button:

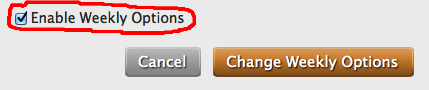

then check the box to enable them and click the Change Weekly Options button:

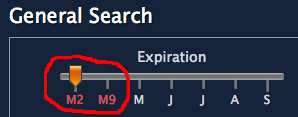

After that you will see new choices on the Expiration slider (weekly dates appear in red). The format is first letter of month followed by day of the month. eg. M2 means May 2nd expiration and M9 means May 9th expiration (the other positions on the Expiration slider, in white, are for monthly expirations):

Which Stocks Have Weekly Options?

Not all stocks or ETFs have weeklys available, but most popular ones do. In late 2020, there are 4513 stocks and ETFs that have monthly options. From those, there are 586 that have weekly options available.

The actual set of symbols that have weeklys available changes from week to week (per the CBOE). You can find the current week's list at CBOE's weekly options list, but if you use Born To Sell's weekly option screener then you don't have to remember any of that because we show all available weeklys to you, as they change week to week.

What's Different When Scanning For Weekly Options?

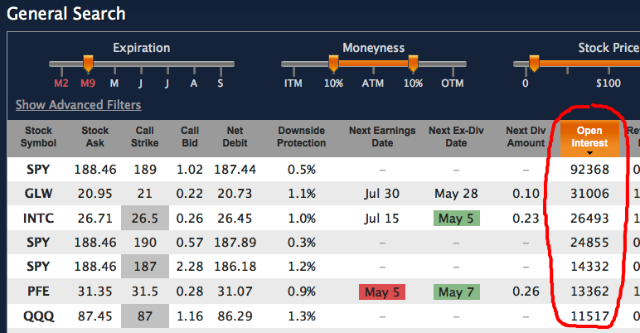

The only difference when screening for weeklys vs monthlies is that we remove the Minimum Open Interest filter when scanning weeklys. The reason is that because they are short lived (by definition, 5 weeks or less), once you get away from the top 20 or 30 symbols (by volume) the open interest in the weeklys is pretty small. If you had a Minimum Open Interest set then you would not see many (if any) results.

The reduced open interest of most weeklys leads to wide bid-ask spreads. So if you're planning on rolling (or closing/exiting) your weekly option position prior to expiration you'll want to stick with weeklys that have fairly tight bid-ask spreads, which is usually the top symbols by volume.

Top Weekly Options By Volume

Currently the top 30 underlying symbols, when looked at from a weekly options open interest point of view, are:

Show Open Interest In Results Table

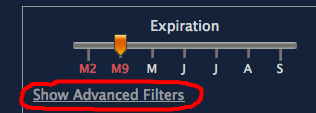

If you'd like to see the open interest for weekly options, go to Show Advanced Filters:

and then Edit Columns:

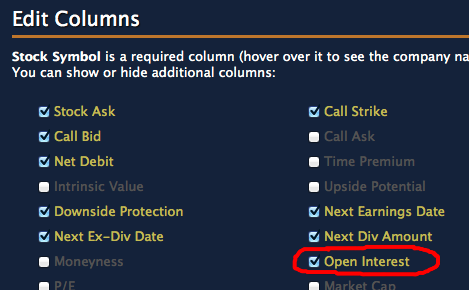

check Open Interest and Save your changes:

In the results table you will see the open interest for each option (and, like the other column headings, you can click on the Open Interest column heading to sort by open interest):

Weekly Covered Calls

Covered calls with weeklys can be fun because you get paid once a week instead of once per month. If the underlying stock stays flat you will collect more premium by selling 4 weeklys (one after the other for 4 weeks in a row) than if you sell a single monthly option (because time decay is faster as options get nearer their expiration date). Just be sure to watch out for wide spreads if you plan to close out prior to expiration.

And when first selling a weekly covered call you'll probably want to use a limit order (as opposed to a market order) at the mid-point of the bid-ask spread (which is a good practice for monthly covered calls, too). For example, if the option you want to sell is bid at $1.00 and ask at $1.20, you'll want to use a limit order for $1.10 -- at the midpoint between bid and ask -- wait a few minutes and it will probably get filled.

Looking for weekly covered calls? Check out our Covered Call Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.