Inverse ETF Covered Calls

Inverse ETFs are ETFs designed to move opposite some other index or benchmark. They normally go up when the asset they track goes down.

Buying an inverse ETF is like shorting a non-inverse ETF. But one advantage is that you don't need a margin account to buy an inverse ETF (whereas you would if you were shorting something). In addition, if you write covered calls on inverse ETFs you can earn time premium and capital gains when the underlying asset falls.

Why Would You Buy An Inverse ETF?

You would buy an inverse ETF for all the same reasons you would short a non-inverse ETF... because you think the price of the underlying asset will fall. Hypothetically, there could be global tensions about war, or US-based tensions regarding government shutdowns or debt ceilings, etc.

Make Money In A Falling Market

Just like shorting stocks, you can make money on a falling asset by buying its inverse ETF. And, the good news for covered call investors is that many inverse ETFs have options available so you can write covered calls on them, thus earning the call premium and at the same time profiting if the asset price falls and the inverse ETF price goes up.

Common Inverse ETFs

The largest inverse ETF is Proshares Short S&P 500 (symbol SH) which has over two billion dollars invested and moves opposite the S&P 500 index (i.e. when the S&P 500 goes down, SH goes up).

Some of the more common inverse ETFs that have options available are:

Symbol |

Name |

Assets |

|---|---|---|

| SH | Short S&P 500 | $2.0B |

| TBF | Short 20+ Year Treasury | $1.4B |

| RWM | Short Russell 2000 | $435M |

| DOG | Short Dow 30 | $284M |

| EUM | Short MSCI Emerging Markets | $242M |

How To Use Inverse ETFs

Many investors use inverse ETFs in a similar manner to buying puts or shorting stocks -- as a hedge against portfolio declines, or whenever they feel the market is poised to go down. If they're long a bunch of individual stocks they can buy a broad-based inverse ETF as a way to have some protection if the market falls.

Inverse ETF Covered Calls

Investors can earn income from this particular hedge by writing call options against it. However, because these ETFs represent baskets of stocks they are typically less volatile than individual stocks and, therefore, have smaller option premiums than single stock covered calls.

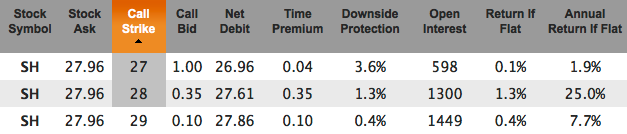

For some example covered calls, here are 3 inverse ETF covered calls on SH: one in-the-money, one at-the-money, and one out-of-the-money for the Oct 19 expiration:

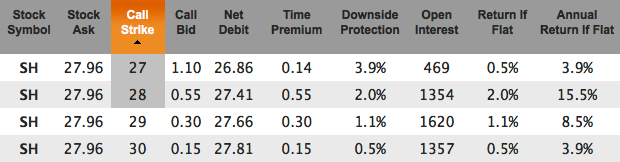

And here are some for the Nov 16 expiration:

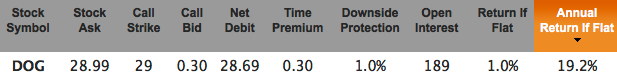

If you'd like something more specific than an inverse on 500 stocks, you could use Proshares Dow 30 (symbol DOG), which is the inverse of the Dow Jones Industrial Average (DJIA). For the October expiration, the at-the-money covered call yields 1% if DOG stays flat or rises (meaning the DJIA stays flat or falls) between today and Oct 19, which is an annualized return of 19.2%:

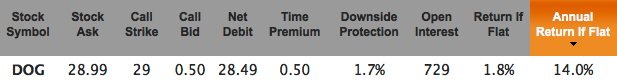

And the Nov 16 expiration at-the-money strike yields 14% annualized:

Investors seeking a non-correlated investment to their existing covered call portfolio, or who feel the market could be heading down, may want to consider an inverse ETF covered call position in addition to, or perhaps instead of, selling their long positions.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.