| Dividends Every Month |

|

Kiplinger magazine had an article on how you could buy a dozen dividend paying stocks that were on different dividend cycles so you'd be assured of getting 4 or more dividends each month. They named 12 companies in the article that they thought you could use to implement the cash-flow-every-month plan. Kiplinger magazine had an article on how you could buy a dozen dividend paying stocks that were on different dividend cycles so you'd be assured of getting 4 or more dividends each month. They named 12 companies in the article that they thought you could use to implement the cash-flow-every-month plan.

We, of course, improved on that strategy by layering in covered calls. Why have 4 cash flow events per month when you can have 9 instead (dividends + staggered call premiums)? Check out our blog article Dividends Every Month to see how we did it.

|

| AAPL Income Trade Prior To New Product Announcements |

|

September 9th is the big announcement date for Apple's next products (two new iPhones and maybe something else to surprise us). Since AAPL has a history of rising before major announcements, the week prior has typically been a good time for a short-term trade.

By selling an in-the-money weekly option on AAPL this week you can get an annualized return of 36.5% and be out of the trade before the reaction to the Sep 9 announcement has a chance to affect the stock.

More conservative investors can earn 13.7% annualized return with an even deeper in-the-money buy-write. And you will be out of it before the possible price-dropping reaction hits the stock. To see the trades, check out Apple Trades For August 29.

|

| Use Covered Calls To Meet RMDs |

|

RMDs, or required minimum distributions, are amounts that the US government requires certain people (over 70.5 years old) to withdraw from various types of retirement accounts each year. But some people have held onto their shares for years (or decades) and may not want to sell them to meet their RMD.

Covered calls to the rescue. Our blog article shows how you can combine dividend payments with covered call income to generate enough cash to cover your RMD (without selling any of your shares). See Meet Required Minimum Distribution With Covered Calls.

|

| Collecting Dividends With Weekly Options |

|

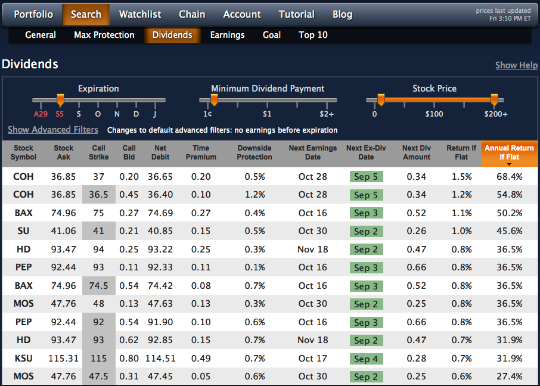

Using the Search->Dividends covered call screener 10 minutes before the close on Friday, we produced the following list of weekly covered calls that have an ex-dividend date prior to the Sep 5 weekly expiration (one week out) but, they also do not have an earnings release before that expiration (to reduce risk) and have an additional filter of 24% annualized return or better (including the dividend). We find 7 stocks that are next week's Weekly Dividends Without Earnings candidates:

But remember, these are not recommendations; they are just all the weekly options that have an ex-div date but no earnings date prior to Sep 5, and have an annualized return of more than 2%/month. You would need to look up each symbol and see if it meets your personal requirements for an investment.

If you're a subscriber to Born To Sell you're already enjoying this kind of screening. If you're not, check out our no-obligation 2 week free trial.

|

| Bond Yields: Even Lower for Even Longer |

|

The WSJ ran an article last Thursday showing how bond yields have continued to fall this year. German 10-year bonds are 0.88%, and their 2-year yield is negative. In the US, the 10-year Treasury yield is 2.32%, down 0.7% this year. And in the UK, 10-years are 2.36%, down from over 3% at the start of the year.

At some point the central banks will stop attempting to heal all economic ills, and rates will rise. But until then, and even after that point for a long time, covered calls (especially on dividend stocks) remain one of the best income-oriented strategies around.

|

| $100K Challenge Underway |

|

The most recent TraderMinute $100K challenge resulted in a $46K gain from a $3K investment. The most recent TraderMinute $100K challenge resulted in a $46K gain from a $3K investment.

Their next $100K Challenge is underway (and up about 10% as of the close Friday) and you can use the Born To Sell discount code to get a free month trial to their Live Seat trading so you can watch and learn how the pros trade options.

|

| AAPL And 3 Other Covered Calls For September 20 Expiration |

|

With about three weeks to go until the September options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | AAPL | 97.5 |

| 2. | T | 36 |

| 3. | SNSS | 7.5 |

| 4. | DAL | 41 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| MSFT And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | MSFT |

| 2. | AAPL |

| 3. | T |

| 4. | INTC |

| 5. | FB |

| 6. | VZ |

| 7. | MU |

| 8. | CSCO |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|