Dividends Every Month

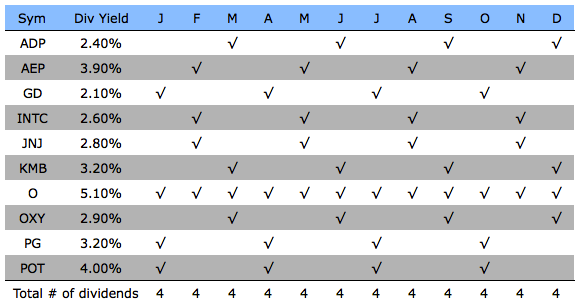

Kiplinger magazine recently ran an article called 12 Stocks To Get Dividends Every Month as a way to get cash payments every month. The 12 stocks mentioned are: ADP, AEP, DON, GD, INTC, JNJ, KMB, MKC, O, OXY, PG, POT (you can read the article to find out why they chose those stocks). If you eliminate 2 of them (DON, MKC) because they either don't have options or the options don't pay very well, then the remaining 10 pay 4 dividends per month:

4 Dividends Per Month... Good Start

It's not a bad strategy to target dividend paying stocks on different cycles so that you have some income coming in every month. That appeals to many people. But you can increase the monthly income even more by layering on a covered call strategy.

9 Dividends Per Month... Even Better

If you split the group of 10 stocks into 2 groups of 5 and write calls on each group that are 2 months out then you will have 5 expiring options every month in addition to the 4 dividends every month, for a total of 9 payments/month.

To get started you'll have to write 1-month options on 5 of the stocks, and then 2-month options on the other 5. When the first group expires (in 1 month) then you can write new 2-month options on that group. So each month you have 5 expiring that you would be re-writing (or perhaps rolling).

The first group of 1-month September 20 expirations could be, for example (Annualized Return If Flat includes dividends):

The second group of 2-month October 18 expirations could be, for example (Annualized Return If Flat includes dividends):

When the September options in the first group expire you would then write November options for the next 2-month cycle on those 5 stocks. Likewise, when the October options above expire you would write December options for the next 2-month cycle on those 5 stocks. By rolling them this way you will get 6 option premiums per year from each stock (in addition to their normal dividends).

Note that each of the above options are slightly out of the money. More conservative investors could do the same strategy with slightly in the money options.

As with all covered calls on dividend paying stocks, make sure you have some time premium left in the option on the day before the ex-div date or else you may have an early exercise on your hands.

Want dividends every month? Check Out Our Dividend Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.