Aggressive Use Of The Income Goal Feature

In the last article we introduced the income Goal feature and showed how to set it up for a fairly conservative use case. In this article we will look at a more aggressive use case.

Aggressive Covered Calls With Margin

The key difference between the conservative case and the aggressive case is the use of margin (borrowing money to invest). In taxable accounts (i.e. not IRA accounts) you can get one of two types of margin depending on your experience level, your broker, and your account size: Reg-T or Portfolio Margin.

Reg-T margin gives you 2:1 leverage and is generally available to smaller accounts, or those investors who have less experience than needed for Portfolio Margin. With Reg-T margin if you have $25K of capital you can use 2:1 leverage and buy up to $50K of stock.

Portfolio Margin (PM) requires $100K minimum account balance and is for experienced investors only. The amount of leverage you get is based on a risk calculation that depends on many factors, including how diversified and/or correlated your positions are. If you choose reasonable diversification (i.e. don’t put 50% of your account into a single position) then you can normally get around 5x to 5.3x leverage. So if you have $100K in capital you can buy just over $500K of stock.

Just because you may have (or qualify for) Portfolio Margin doesn’t mean you have to max it out at 5x. That’s why the Goal feature has a Use Of Margin slider where you can choose how much leverage you plan to use. Whether you have Reg-T or PM, it is rarely a good idea to max out your available margin because if the market moves against you then you could have a margin call). Maybe use 1.5x for Reg-T, or 3x for PM, but it depends on your bullishness and risk tolerance (and possibly the availability of cash outside your trading account that could be used to meet a margin call should it occur).

Aggressive Covered Calls Example

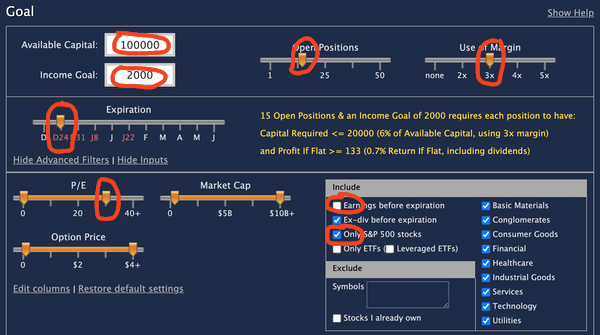

For this example, we will assume you have $100,000 capital available, and will use 3x leverage via Portfolio Margin. This will give you $300,000 in purchasing power so we will assume 15 open positions. We will also assume you want to make $2000 in income in the next 10 days (2% by a week from this Friday). Because we are using borrowed money to invest, we will leave the PE cap at 30, and stick to S&P 500 stocks that do not have earnings before expiration. The filter screen should look like this:

And to recap the yellow text: If you have 300K available for 15 positions then each one needs to take $20K or less and generate 1/15th of your profit goal (2000), or $133 or more.

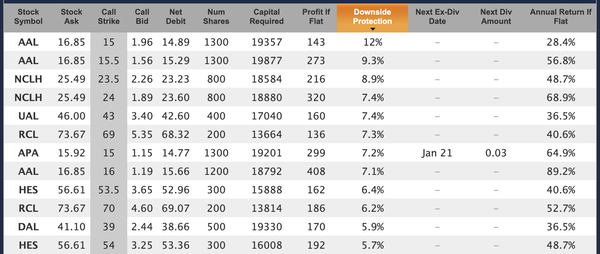

Here are some of the resulting trade candidates:

Note that some symbols appear more than once (AAL, for example). It should be obvious, but you’d only want to choose 1 position for any given symbol.

Compare the first two rows. Both are for AAL. The only difference is that one has a 15 strike and generates $143 in profit if AAL is above 15 on Dec 24, while the other has a 15.5 strike and generates $273 in profit if AAL is above 15.5 on Dec 24. Clearly the lower strike is lower risk, but both meet your profit goal of more than $133 per position. For diversification, and assuming you like AAL as one of your 15 positions, you would only pick one of the AAL positions.

Don't Forget Trading Costs

Note that we have ignored commissions in this example. The cost to buy 15 stocks and sell 15 sets of options, and then (hopefully) have them all assigned is likely going to be between $0 and $300 depending where you trade. You may want to add your anticipated trading costs (commissions) to your income goal (so use $2300 instead of $2000 if your commissions are expected to be $300) so that you don’t come up short at the end of the period.

And The Cost Of Borrowing

Also, margin money isn’t free. Although right now it’s pretty close (again, depending where you trade). To borrow $200K at InteractiveBrokers will cost you a blended rate of 1.34%, so for 8 days your margin interest cost will be about $59. Other brokers could charge 6.5% for this same margin amount, so your interest cost would be $285 in that case.

Making $2000 per week consistently off $100K capital base is not easy. Using margin will lower the amount of profit each position needs to generate (so you can go deeper in the money and have more downside protection), but borrowed money always has the risk of a major drawdown during the borrowing period. And remember that 2%/week is over 100%/year, which is extremely good (and probably not attainable for dozens of weeks in a row). Still, if you shoot for 100%/year and end up at 30-40%/year (after factoring in the losing weeks, which will happen) then you’re still doing remarkably well.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.