Covered Call Option Screener

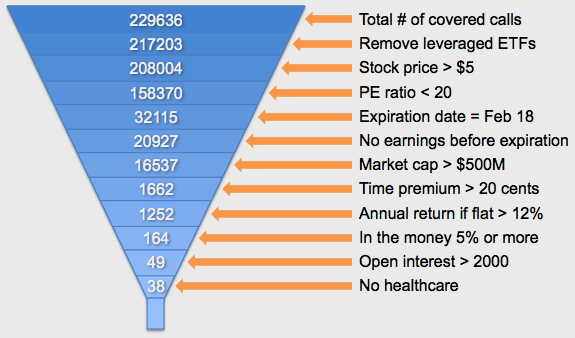

Born To Sell is in the business of screening for covered calls. We are constantly asked how to use a covered call option screener effectively. Investors know that a screener will save them time, but how to do you reduce the universe of 200,000+ covered call candidates down to a handful that you can then do additional diligence on? Here's how.

How Many Covered Calls Exist?

There are 5643 stocks and ETFs that trade today (Jan 25, 2012). Of those, 3716 have call options available. Factor in all the possible expiration dates and strike prices, and there are 229,636 covered call possibilities for today.

Using A Covered Call Option Screener

Not all covered call candidates are worthy of your attention. Here is one possible screen that shows how the universe shrinks as you layer on additional filters:

Logic behind each filter:

Leveraged ETFs: These ETFs use 2x or 3x leverage and only track their benchmark for a day (start of each day resets their tracking). Because of that they are not good covered call candidates, unless you are talking about very short-term trades (few days); but even then you need to be really careful.

Stock price > $5: Don't mess with low-priced stocks.

P/E Ratio < 20: Removes some high fliers. These are often momentum stocks that pay good call premium. But when they fall from grace the drop in stock price can be brutal (check out the NFLX chart from July to December last year).

Expiration date = Feb 18: The next available monthly expiration date. Writing short term options results in better time premium capture (as long as your transaction costs aren't large relative to the premium collected).

No earnings before expiration: If you're doing short-term, income-oriented buy-writes then don't take earnings risk. Yes, the premiums are high for stocks about to release earnings but the stock could drop below your break even point overnight.

Market cap > $500M: Much like the $5 stock price rule, don't mess with small caps in an income-oriented portfolio. Too volatile.

Time premium > 20 cents: This is to avoid having transaction costs eat up too much of your profit. If you are dealing with a large number of shares then transaction costs are probably not an issue and you can relax this rule.

Annualized return if flat > 12%: If you're not making at least 1% per month then it may not be worth it. For core holdings where you write out-of-the-money calls to get a little extra income you can relax this rule (in those cases even 6%/year would be a nice increase in yield).

In the money 5% or more: This assumes we are looking for new buy-writes where we hope we are called away at the next expiration. This gives us at least 5% downside protection in the underlying stock price.

Open interest > 2000 contracts: Higher open interest results in tighter bid-ask spreads, which will be important if you want to roll this position later. Wide spreads on thinly traded option series make it expensive to roll.

No healthcare: There's nothing wrong with heathcare but in the case of this screen the healthcare stocks that showed up were all pretty volatile (DNDN, INHX, VVUS, ACHN, MAKO) so we decided to eliminate the group this time.

So what are we left with?

The 38 covered calls that remain satisfy all of the above requirements. Now we can begin to look at each one individualy and ask ourselves: If we are not called away at expiration are we comfortable holding these stocks until the next expiration cycle (or even longer)? If not, then don't buy it just for the yield...look elsewhere.

Aggressive type investors can look for ideas at the top of this list. More conservative investors will want to look towards the bottom of this list. In some cases the same symbol appears twice (FCX, LNG, RIMM, SWN). In those cases the more conservative approach is to choose the one with the lower strike price.

"Net Debit" is the asking price for the stock minus the bid price for the call (i.e. it is your cost to get into the trade if you buy the stock and sell the call). The difference between the Net Debit and the Call Strike is the amount of time premium (per share) you will make if the stock is called away on expiration day

As always, do your homework. This is just a screen, not a list of recommendations.

All of these are for the Feb 18 expiration.

Stock |

Call Strike |

Net Debit |

Annualized Return If Flat |

|---|---|---|---|

| LNG | 11 | 10.35 | 95.8% |

| PSS | 15 | 14.42 | 60.8% |

| RIMM | 15 | 14.50 | 51.7% |

| SD | 8 | 7.75 | 48.7% |

| LNG | 10 | 9.75 | 39.5% |

| MBI | 12 | 11.73 | 35.0% |

| MHS | 57.5 | 56.22 | 35.0% |

| SHLD | 40 | 39.15 | 33.5% |

| MMR | 10 | 9.79 | 31.9% |

| AGO | 15 | 14.71 | 30.4% |

| MS | 17 | 16.72 | 30.4% |

| SWN | 31 | 30.42 | 28.9% |

| RIMM | 14 | 13.75 | 27.4% |

| CHK | 22 | 21.63 | 25.9% |

| FCX | 44 | 43.27 | 25.9% |

| IAG | 16 | 15.75 | 24.3% |

| C | 28 | 27.60 | 22.8% |

| ROC | 45 | 44.35 | 22.8% |

| DD | 48 | 47.69 | 22.8% |

| XOP | 54 | 53.27 | 21.3% |

| SLW | 32 | 31.60 | 19.8% |

| SLV | 30 | 29.62 | 19.8% |

| WAG | 33 | 32.79 | 19.8% |

| PBR | 30 | 29.62 | 19.8% |

| RIG | 45 | 44.45 | 18.3% |

| HPQ | 27 | 26.69 | 18.3% |

| HAL | 34 | 33.62 | 16.7% |

| WPRT | 35 | 34.62 | 16.7% |

| FCX | 43 | 42.54 | 16.7% |

| SWN | 30 | 29.66 | 16.7% |

| EWZ | 63 | 62.40 | 15.2% |

| GDX | 52 | 51.48 | 15.2% |

| OXY | 97.5 | 96.65 | 13.7% |

| USO | 36 | 35.73 | 12.2% |

| JPM | 35 | 34.73 | 12.2% |

| GPOR | 30 | 29.76 | 12.2% |

| EFA | 50 | 49.61 | 12.2% |

| EEM | 40 | 39.69 | 12.2% |

Want to try it? Find Good Covered Calls With Our Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.