Conservative Use Of The Income Goal Feature

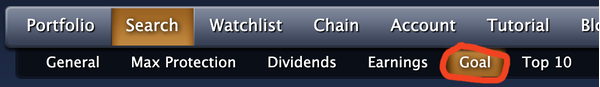

One of Born To Sell’s unique features is called Goal (short for Income Goal). You won't find anything like it on any other site. This planning/research tool helps you achieve your income goal. When logged in, it is a sub-menu under Search, called Goal:

Goal can be used conservatively, or very aggressively. We’ll take a look at two examples, starting with the conservative case in this article and the aggressive case in the next article.

Conservative Covered Call Goal Example

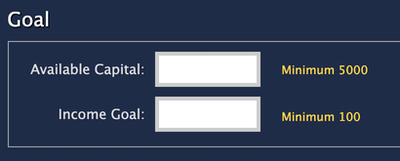

Start by telling the Goal feature how much capital you have to invest, how much income you are looking for:

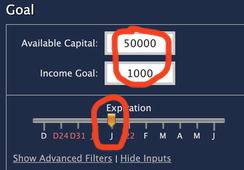

Let’s say you have $50K and you would like $1000 in income in the next 5 weeks, enter 50000 and 1000, and set the Expiration slider to 5 weeks out (Jan 15):

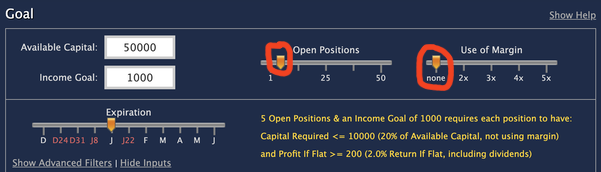

You also need to say how many Open Positions you want to have at one time, and whether or not you’re going to use any margin. Since this is a conservative example, let’s say 5 open positions and no margin. Now the top of the page should look like this:

The text in yellow gives the summary of your settings. Since you have $50K and want 5 positions, you’ll need each position to be $10K or less. And since you want $1000 in income, each position needs to generate $200 or more in profit.

Below the settings panel you will see a list of candidate trades. These are not trade recommendations since we are not a trade recommendation service. These are just a list of all the trades that mathematically meet the requirements you defined. You would choose any 5 of them to try and make your income goal.

We can use additional filters to increase your odds of success by removing some common elements of risk/volatility. Click on Show Advanced Filters. That pops open a panel of filters with these default settings:

To reduce risk, make these 3 changes:

- uncheck Earnings Before Expiration (to remove earnings risk)

- check Only S&P 500 stocks (to remove tiny, typically volatile, companies)

- change max P/E to 30 (sorry TSLA, and other high PE companies)

Then it should look like this:

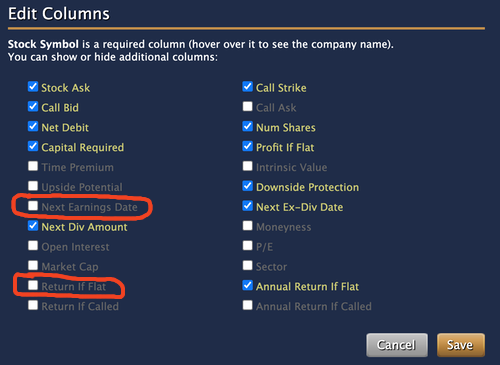

To make our screen shots of the results easier to read in this article, we’re going to click on Edit Columns and turn off (uncheck) Next Earnings Date (not needed because we unchecked Earnings Before Expiration so none of the results will have earnings before expiration) and Return If Flat (we’ll use Annual Return If Flat instead):

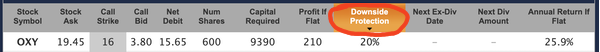

Last step: click on the Downside Protection column header on the results table in order to sort the results by that column (which puts the deepest in the money candidates at the top):

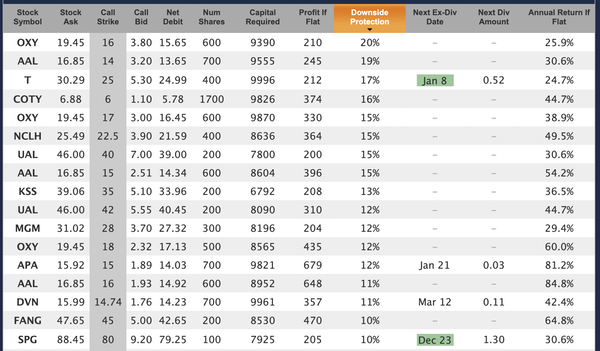

Now we have a table of candidate trades to help us reach our goal, sorted from those with the most downside protection to the least. Since we said we wanted 5 open positions we should pick 5 from this list.

But what does each row mean?

Let’s look at the first row: OXY. It’s telling us that if we buy 600 shares of OXY stock and pay the stock's asking price of 19.45 and then sell 6 contracts (call options, one per 100 shares we own) with a strike of 16 (from the Call Strike column) and an expiration of Jan 15 (from the Expiration slider) and receive the call bid of 3.80 then our Net Debit (per share) is 15.65. Multiply by 600 and the Capital Required for this trade is $9390. [Note: we are assuming market orders to buy the stock and sell the options; you can do better by using a limit order at the midpoint of the bid and ask.]

If OXY is above the strike of 16 on expiration day (Jan 15) then it will be called away and we will have received a profit of $210 (which is 600 x $0.35 per share). The 20% Downside Protection means that OXY would have to drop by more than 20% from today's price before we’d have a loss (i.e. close below our net debit of 15.65 on expiration day).

So that’s one trade. Now choose 4 more from the list. Combined, those 5 trades will yield more than $1000 in profit if (1) the in-the-money ones you choose are called away, and (2) the out-of-the-money ones you choose are at the price you paid or higher on expiration day. Here are some of the candidate trades (all in-the-money):

Ideally you want to choose uncorrelated trades. So don’t pick 5 oil companies, or 5 tech companies. Maybe one from each of 5 industry sectors would be a good way to diversify, if there are enough candidates that you like to do so.

In this example we were looking to make $1000 on a $50K investment in 4.5 weeks. That works out to 2% in 4.5 weeks, or about 23% annualized return. In the next article we’ll look at a much more aggressive use of this tool.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.