Naked Put vs. Covered Call

Selling a naked put (or cash-secured put) is the same as selling a covered call. They have identical profit and loss graphs if you use the same strikes and expiration dates. However, there are a few differences that may make naked puts more or less attractive than covered calls depending on your circumstances.

What Is A Naked Put?

A "naked put" is an uncovered put option that you have sold. It is "uncovered" (or "naked") if you have not shorted an equivalent number of shares of the underlying stock. If the put option is assigned to you then you will have the shares put to you at a price equal to the strike price per share.

Example Naked Put

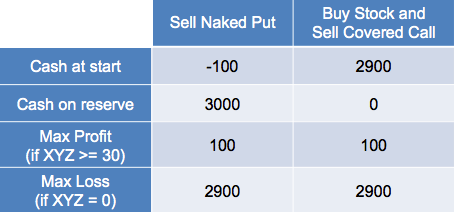

Imagine XYZ stock is trading at $32 per share. You think it will stay flat or go up so you sell (short) 1 naked put option with a strike of $30. You receive income today (let's say $1/share) in exchange for accepting the obligation that if XYZ drops below 30 you will have 100 shares put to you at $30/share (costing you $3000, but then you would own 100 shares of XYZ).

The most profit you can make with a naked put is if the option expires worthless (i.e. XYZ is above $30 on expiration day). You keep the option premium you received ($1/share) and are relieved of your obligation once the option expires.

The most you can lose is the strike price per share minus the option premium you receive. So if you got $1 for that 30-strike put you sold then your max loss is $29/share. If XYZ stock becomes worthless you will have 100 shares put to you for $30/share, but you received $1/share in option premium when you sold the put.

How Would A Covered Call Work In That Case?

Same scenario: XYZ is selling for $32/share. You buy 100 shares and sell a 30-strike call option for $3 (which is $2 of intrinsic value and $1 of time premium, since the option is 2 points in the money at the time you sold it).

The most profit you can make is if XYZ stays above $30 on expiration day. You will make the amount of time premium per share ($1 per share). Same profit as in the naked put case.

The most you can lose is your net debit per share. Your net debit is the price you paid for the stock ($32) minus the amount you received for the call option ($3), or $29/share. If XYZ stock becomes worthless by expiration you could lose $29/share. Same as in the naked put case.

Naked Puts and Covered Calls Have The Same P&L

So What Are The Differences?

- Permissions. Some brokers will not allow naked writing of options (eg. naked puts) in some accounts, such as IRA accounts, or in accounts where the account holder has limited option trading experience. However, brokers will allow covered calls in all accounts.

- Commissions. Selling a naked put is 1 transaction and 1 commission. Selling a covered call (if you don't already own the underlying stock) is 2 transactions and 2 commissions: (1) buy stock, and (2) sell the call option. There is also the possibility of an additional commission if the naked put or covered call is assigned to you. Depends on where you trade. Some brokers (like Interactive Brokers) do not charge for assignment.

- Dividends. If you own a dividend paying stock with covered calls you will receive dividends. If you don't own the stock (naked puts) you won't get the dividends.

- Margin. If you are trading on margin (Reg T or Portfolio Margin) there can be differences in the margin requirements for a covered call vs. a naked put (again, depends on your broker).

- Interest. Some brokers will pay interest on cash reserved for possible put assignment.

Which Is Better?

If you trade at a broker where the extra commission of a covered call matters then you should be looking for a lower cost broker. If you trade in stocks that pay dividends then you probably want to limit yourself to covered calls.

Some investors have a hybrid strategy of selling naked puts until they are assigned (so now they own the stock) and then turn around and sell a covered call at the same strike (called a "wheel" trade). There's nothing wrong with that but it's the same as starting with a covered call, have it expire out of the money, and then writing another covered call at the same strike. Using naked puts and then switching to covered calls can be confusing if you manage many different positions. After all, which would your rather do, mix blue and yellow until you get green, or just start with green from the beginning? We recommend sticking to covered calls for simplicity and dividends. Green is good.

Additional Naked Put Info

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.