10 Best Stocks for No-Doubt Dividends

10 Best Stocks for No-Doubt Dividends

Kiplinger magazine's article The 10 Best Stocks to Invest In for No-Doubt Dividends lists stocks that consistently pay and raise their dividends through bull and bear markets alike.

The 10 stocks Kiplinger chose are: AAPL, CL, EPD, JNJ, KMB, MCD, MMM, NNN, O, and PG (you can read the article to find out their comments on each of those stocks).

Dividend Yield

Those 10 stocks have annual dividend yields ranging from 6.4% to 1.4%:

| Symbol | Ask Price | Div | Yield |

|---|---|---|---|

| EPD | 26.90 | 1.71 | 6.4% |

| O | 50.36 | 2.63 | 5.2% |

| NNN | 37.92 | 1.90 | 5.0% |

| KMB | 102.98 | 4.00 | 4.1% |

| PG | 72.49 | 2.87 | 3.7% |

| JNJ | 128.74 | 3.36 | 2.6% |

| MCD | 158.59 | 4.04 | 2.5% |

| CL | 66.51 | 1.68 | 2.5% |

| MMM | 197.45 | 5.44 | 2.5% |

| AAPL | 164.32 | 2.52 | 1.4% |

Warren Buffett has said that you should only buy stocks you'd be perfectly happy to hold if the market shut down for 10 years. These are those kinds of stocks. If the market were to close tomorrow, you'd continue to collect the dividend indefinitely.

Not all of these picks are exceptionally high-yielding. In fact, a high yield sometimes can be a sign of trouble. But most of these dividend stocks to invest in generally will pay a yield that is at least competitive with the bond market, and most have long histories of raising their dividends over time.

Increasing The Yield With Covered Calls

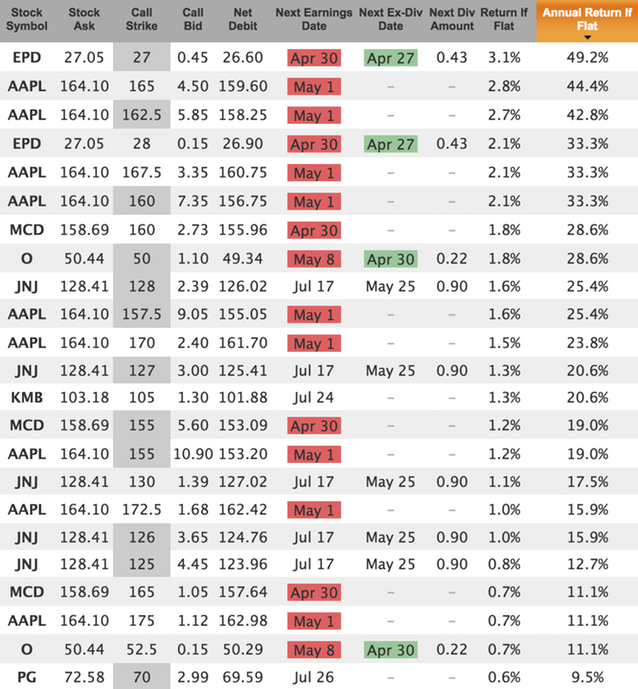

Those are nice yields but we can do better by adding covered calls to those stocks. For example, the May 18, 2018, expiration has these annualized yields available today:

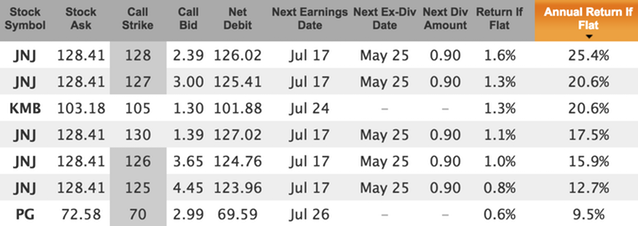

If we remove the Earnings Before Expiration, we're left with these 3 companies:

Higher Yield Than Buy-And-Hold

Owning a diversified portfolio of large cap, blue-chip, dividend paying companies is a good basis for a long-term covered call strategy. As always, though, because everyone's situation is different, you shouldn't take Kiplinger's word for it that these are the right stocks for you. Do your own research, stay diversified, keep your positions reasonable, and make sure they are appropriate for your personal risk/reward profile.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.