Ibbotson Case Study on BXM

Ibbotson Associates, now part of MorningStar, conducted a case study of the investment value of the CBOE S&P 500 BuyWrite (BXM) Index from a total portfolio perspective. The study assessed risk-adjusted performance, taking into account the skew and kurtosis of the covered call strategy.

Summary Of Results

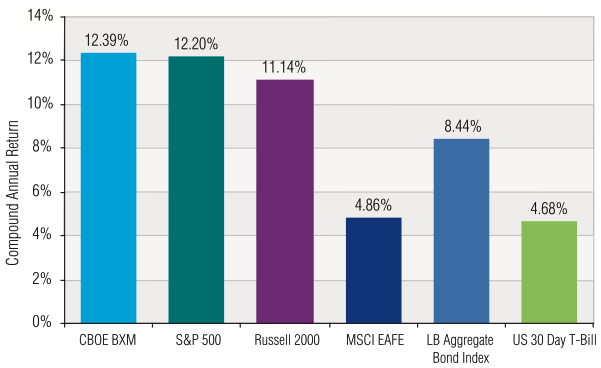

The results showed that the BXM Index has had relatively good risk-adjusted returns during the study period (1988 to 2004). The compound annual return of the BXM Index over the almost 16-year history of this study is 12.39 percent, compared to 12.20 percent for the S&P 500, and the BXM had about two-thirds the volatility of the S&P 500.

Better returns:

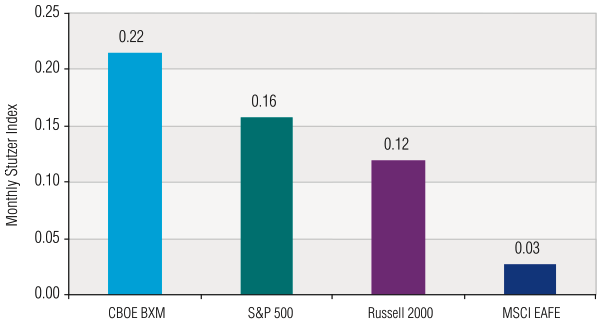

Lower risk-adjusted returns (Stutzer Index values):

Comparisons of Returns and Standard Deviations

During the 190-month time period studied, the BXM Index had:

- Higher returns and quite a bit lower volatility than the S&P 500, Russell 2000 and MSCI EAFE stock indexes.

- Higher returns and higher volatility than bonds and Treasury bills.

- High risk-adjusted returns as measured by the Stutzer Index, even when taking into account the negative skew. A monthly buy-write strategy takes in premium income and has a truncated monthly upside as the option is exercised above the strike price. Therefore, the buy-write strategy may be expected to outperform stocks in bear markets and underperform stocks in bull markets.

For even more data, download the Ibbotson Associates case study on BXM Buy-Write Options Strategy.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.