Any Dividend Yield For Any Stock (Almost)

Any Dividend Yield For Any Stock (Almost)

By writing out of the money covered calls on stocks you own, it is possible to generate almost any reasonable annual yield, plus leave yourself some upside on the underlying stock. You can receive 12 dividend-like payments per year.

The math is straighforward. In order to calculate how much call premium you need to capture in a year you need to know the stock price and your desired annual yield.

For example, say you have a $50 stock and you want a 5% annual yield from it.

You need $2.50 ($50 x 5%) per year in annual call premium to get 5% yield.

If we divide that $2.50 by 365 days in a year, you need to capture about 0.69 cents per day in time premium. Said another way, if you receive 0.69 cents per day for a year then you'd have achieved your goal of $2.50 (5%) in annual yield.

Makes Sense. So How Do We Find Time Premium Per Day?

You need to find out of the money call options for this stock where the time premium remaining is more than (0.69 * the number of days until the option expires). If the option has 10 days remaining, you need to get 6.9 cents for it (or more). If the option has 20 days remaining you need to get 0.69 cents times 20, or 13.8 cents, for it.

That seems like an awful lot of math that computers should be able to do.

You're right. And we've done it for you.

Yields of 3%, 5%, or 10%

We have created new pages that calculate which out of the money options you would need to sell if you wanted a 3% yield, a 5% yield, or a 10% yield. Here are some examples for a few popular symbols:

The general form of the URL you can use is:

https://www.borntosell.com/dividend/SYMBOLand replace

"SYMBOL"with the symbol of the stock or ETF you want.

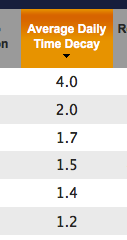

Average Daily Time Decay

There is another way to find average daily time decay, too. Members of Born To Sell can go to the Chain page, click on Edit Columns and check the box next to "average daily time decay":

![]()

That will cause a new column to appear on the Chain page, showing you the number of cents per day that you will collect for each option. You can click on the column header to sort by that column. And then if you know you need 2 cents per day in time premium to reach your annual yield goal then it's a simple matter to find matching call options:

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.