Energy Stocks For The Next 4 Years

Aaron Levitt's article My 7 Favorite Energy Stocks for the Rest of Trump’s Presidency at InvestorPlace.com points out from the early days of the campaign trail, Donald Trump made it clear that he is a traditional-energy man. Coal, oil, nuclear - you name it, and he supported it. That has helped to support the energy sector from his election through today. And after Rick Perry's first policy speech as Energy Secretary we now know which energy stocks will keep on going in today's new reality - fracking, mining and exporting fossil fuels overseas.

Aaron's Energy Stocks

Given that backdrop, Aaron came up with 7 energy stocks he likes, 4 of which currently offer double-digit covered call returns:

| Symbol | Ask Price | Div | Yield |

|---|---|---|---|

| EOG | 91.87 | 0.67 | 0.7% |

| HAL | 45.30 | 0.72 | 1.6% |

| RRC | 26.53 | 0.08 | 0.3% |

| VLO | 64.49 | 2.80 | 4.3% |

Covered Calls On Aaron's High Dividend Stocks

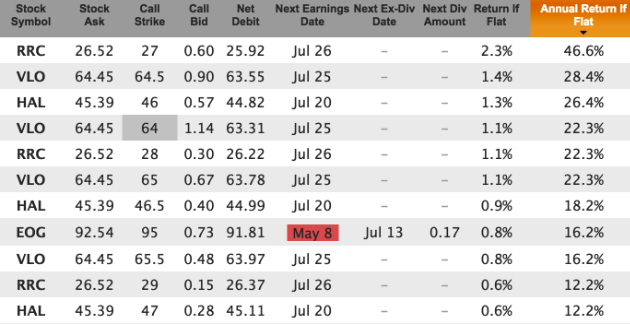

If you plug these 4 into Born To Sell's Watchlist feature, you find several combinations of strike prices and expiration dates that yield at least 1%/month or more on an annualized basis (i.e. their Annual Return If Flat is >= 12%). For example, here are 11 covered call combinations expiring May 19 (a 17-day trade):

One of those (EOG) has earnings before expiration so beware of that.

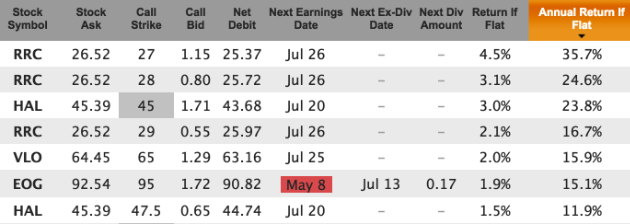

If we go out a month farther to the June 16 expiration, we find 7 combinations yielding 11% or more on an annualized basis, with one (EOG) that has earnings before expiration:

Note: These are not trade recommendations. These are candidate trades based on Aaron's suggested energy stocks for the next 4 years (see his article for his reasons). Do your own research, keep position sizes modest, and stay diversified.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.