World's First Trillion Dollar Company

World's First Trillion Dollar Company

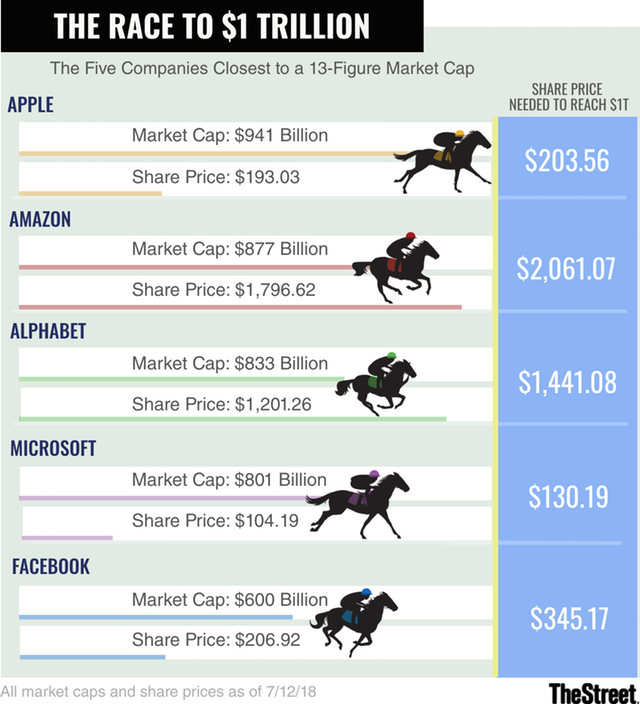

Five tech companies are currently competing to see who can be the first to achieve a one trillion dollar ($1,000,000,000,000) market cap:

| Name | Current Market Cap |

Current Share Price |

Trillion $ Share Price |

% Gain To $1T |

|---|---|---|---|---|

| Apple | 941B | $193.03 | $203.56 | 5.5% |

| Amazon | 877B | $1796.62 | $2061.07 | 14.7% |

| Alphabet | 833B | $1201.26 | $1441.08 | 20.0% |

| Microsoft | 801B | $104.19 | $130.19 | 25.0% |

| 600B | $206.92 | $345.17 | 66.8% |

Or, visually, courtesy of TheStreet:

Covered Calls On A Trillion Dollar Company

In addition to being large cap tech stocks, these 5 companies also make pretty good covered call candidates, so long as you can handle some volatility. Plus you need a pretty big portfolio to write covered calls on GOOGL and AMZN given their stock prices (because 100 shares of AMZN costs about $180K).

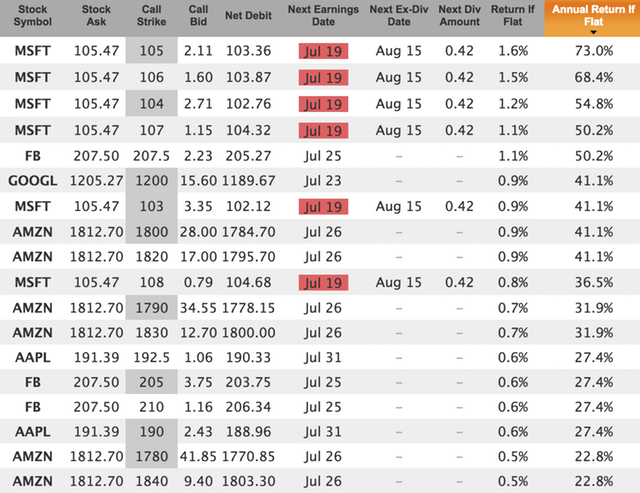

But if you did want to write calls against these, they are all offering 20% or more annualized return for at-the-money (or very near the money) options for next Friday's (July 20) expiration:

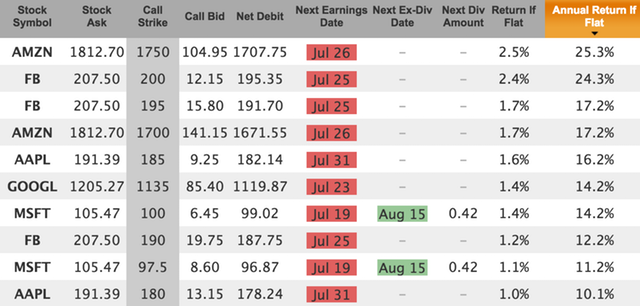

If you want to go out to the next monthly expiration (August 17) you will have to deal with an earnings release. Might want to do an in-the-money buy-write to reduce some earnings risk. Here are a few ITM candidates yielding 10% or more annualized return:

These companies have all had pretty good runs recently, so any earnings weakness (or weak forecast) could cause a correction. As always, do your homework, keep position sizes modest, and stay diversified.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.