High Frequency Trading

High Frequency Trading

High-frequency trading (HFT) accounts for around 3/4ths of all daily trading volume. These firms' average holding time is often less than a second. They submit thousands of bids and then cancel the vast majority of them before they are executed. Although HTFs compete mostly with other HFTs, their presence in the market affects all of us, and not necessarily for the better (remember the flash crash?).

Declining HFT Profits, But Still A Lot Of Nickels

In 2011, HFTs' US profits are estimated at $1.5 billion, which is down considerably from their 2008 take of $4.5 billion. Sniffle.

A large part of that decline is because of narrower spreads. In 2008, HFTs averaged a per-trade profit $0.001 to $0.0015 per share (that's one-tenth of one cent per share to 1.5 tenths of one cent per share), but today they are averaging half of that, or $0.0005 and $0.00075 per share -- so if they are trading 100 share blocks a buy-sell trade nets them 5 cents to 7.5 cents.

Side note: if you had a billion dollars worth of nickels it would weigh 220 million pounds. And if you want to read about a guy who sold a 5 cent product to create a multi-billion dollar company, check out Two Billion Dollars In Nickels.

Side note: if you had a billion dollars worth of nickels it would weigh 220 million pounds. And if you want to read about a guy who sold a 5 cent product to create a multi-billion dollar company, check out Two Billion Dollars In Nickels.

Data Traffic Jam

The consequence of so much rapid fire trading is a data traffic jam on the exchanges' quoting systems. HFTs typically place a huge number of bids and then cancel most of them before filled. The traffic problem is so large that the exchanges are doing something about it. NASDAQ has said that HFTs who exceed a ratio of 100-to-1 for orders-to-trades will have to pay a fee. Likewise, Direct Edge is reducing its rebate for firms that exceed that ratio.

HFTs Don't Like Small Caps

Because of their need for extreme liquidity, HFTs typically stay away from small and micro cap stocks. What makes a small cap? Anything with a market capitalization of $2 billion or less, which gives you over 3400 stocks to choose from:

Number Of US Listed Securities By Market Cap

| Size | Market Cap | NYSE | Nasdaq | Amex | Total |

|---|---|---|---|---|---|

| Large | Over $10 billion | 414 | 80 | 1 | 495 |

| Mid | $2 billion - $10 billion | 431 | 157 | 5 | 593 |

| Small | $300 million - $2 billion | 669 | 786 | 45 | 1500 |

| Micro | Below $300 million | 241 | 1439 | 272 | 1952 |

| Total | 1755 | 2462 | 323 | 4540 |

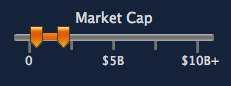

To filter by Market Cap using Born To Sell's covered call screener, look in the Advanced Filters area an set the maximum market cap to $2 billion. If you're worried about HFTs, that should keep you out of the way of most of them:

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.