Johnson Controls Covered Call Trade

On January 20, 2016, an investor made a large ($10+ million) covered call trade in Johnson Controls (JCI). This investor purchased 335,800 shares of JCI at $34/share and then wrote 3,358 in-the-money April calls with a strike of 31. Let's analyze the trade.

| Action | Price | |

|---|---|---|

| Buy JCI stock | $34.00 | |

| Sell April 31-strike call | $3.90 | |

| Net Debit | $30.10 |

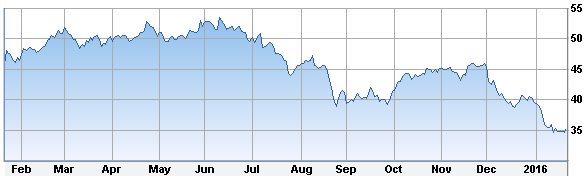

JCI Stock Price Last 12 Months

The call premium received ($3.90/share) has lowered his cost to $30.10 ($34 - $3.90). This investor will have a profit if JCI closes above 30.10 (net debit) on Friday, April 15, 2016.

Max profit for this trade will be achieved if JCI closes above the strike price, 31, on April 15. If that happens the investor will make 0.90/share (31 - 30.10), or 3% (0.90 / 30.10) in 86 days. That's an annualized return of 12.7% (3 / 86 * 365).

Factor In The Dividend

However, JCI also pays a 0.29 dividend in March, which this investor will get before the trade expires. Therefore, the real profit per share (if called) is 0.90 plus 0.29, or 1.19 per share. If the stock is called at 31 then the profit at expiration is 3.95% (1.19 / 30.10) in 86 days, or 16.8% annualized.

How's He Doing After 1 Day?

Today (1 day after the trade was put on) JCI closed at 35.24, which is $1.24/share higher than this investor paid. Nice gain so far, and the stock would have to drop $5.14 (14.6%) from today's close before this investor would lose money.

Cash Outlay And Potential Profit

This investor's cash outlay was $10.1M (335,800 * 30.10), and the max profit (including the March dividend) is a few dollars less than $400K.

Earnings Coming Up

Be aware: JCI has an earnings release before the market opens on Jan 28.

So there's a glimpse into how the big boys use covered calls. As always, this is not a trade recommendation. Do your own research, keep position sizes modest, and stay diversified.

Apr 16, 2016: Post-expiration followup... This trade finished in the money! Click here to read the details.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.