Mutual Funds That Use Options

The Institute For Global Asset And Risk Management (INGARM) released a new study today called Performance Analysis of Options-Based Equity Mutual Funds, CEFs, and ETFs. Two PhDs, Keith Black and Edward Szado, studied 119 mutual funds that use options and analyzed their risk-adjusted performance. Some have used options since 1988.

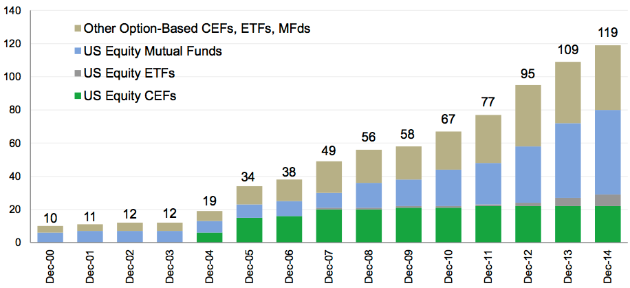

Growth In Number Of Mutual Funds That Use Options

The number of Options-Based Funds grew from 10 in 2000 to 119 in 2014:

Key Findings For Options-Based Funds

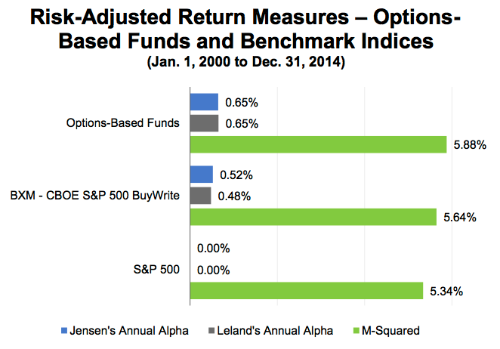

The study performed an analysis of the equal-weighted performance of 80 Options-Based Funds that focus on use of U.S. stock index options and/or equity options during the 15-year period from 2000 through 2014, and had two key findings:

(1) Higher risk-adjusted returns. The Options-Based Funds had similar returns as the S&P 500 Index with lower volatility and lower maximum drawdowns. Said another way, the Options-Based Funds had higher risk-adjusted returns, as measured by the Sharpe Ratio, Sortino Ratio, and Stutzer Index. In addition, using the S&P 500 as a base, the Options-Based Funds and the CBOE BuyWrite Index BXM had better risk-adjusted returns using 3 measures:

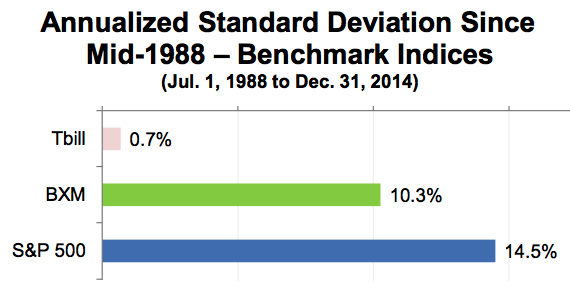

(2) Strong performance for benchmarks that use SPX index options. From mid-1988 to the end of 2014, the CBOE S&P 500 2% OTM BuyWrite Index had higher returns and lower volatility than the S&P 500 Index. Here are the standard deviations, where a smaller number is better (less volatility):

Download The Study

To see more data, download the 30-page study as a PDF file: Performance Analysis of Options-Based Equity Mutual Funds, CEFs, and ETFs.

List Of Closed End Funds (CEFs) That Use Options

CEF |

Symbol |

|---|---|

| AllianzGI NFJ Dividend Interest & Premium Common | NFJ |

| BlackRock Enhanced Capital & Income Common | CII |

| BlackRock Enhanced Equity Dividend Common | BDJ |

| Columbia Seligman Premium Technology | STK |

| Eaton Vance Enhanced Equity Income Common | EOI |

| Eaton Vance Enhanced Equity Income II Common | EOS |

| Eaton Vance Risk-Managed Diversified Equity Income Common | ETJ |

| Eaton Vance Tax-Managed Buy-Write Income Common | ETB |

| Eaton Vance Tax-Managed Buy-Write Opportunities Common | ETV |

| Eaton Vance Tax-Managed Dividend Equity Income Common | ETY |

| First Trust Enhanced Equity Income Common | FFA |

| Guggenheim Enhanced Equity Income Common | GPM |

| Guggenheim Enhanced Equity Strategy Common | GGE |

| Guggenheim EW Enhanced Equity Common | GEQ |

| Madison Covered Call & Equity Strategy | MCN |

| Madison Strategic Sector Premium Common | MSP |

| Nuveen Core Equity Alpha Common | JCE |

| Nuveen Dow 30 Dynamic Overwrite | DIAX |

| Nuveen NASDAQ 100 Dynamic Overwrite | QQQX |

| Nuveen S&P 500 Buy-Write Income | BXMX |

| Nuveen S&P 500 Dynamic Overwrite | SPXX |

| Nuveen Tax-Advantaged Dividend Growth Common | JTD |

List Of Exchange Traded Funds (ETFs) That Use Options

ETF |

Symbol |

|---|---|

| First Trust High Income ETF | FTHI |

| First Trust Low Beta Income ETF | FTLB |

| Horizons S&P 500 Covered Call ETF | HSPX |

| Horizons US Equity Managed Risk ETF | HUS.U |

| PowerShares S&P 500 Buy-Write ETF | PBP |

| Recon Capital NASDAQ 100 Covered Call ETF | QYLD |

| US Equity High Volatility Put Write ETF | HVPW |

List Of Mutual Funds That Use Options

Mutual Fund |

Symbol |

|---|---|

| Alliance Bernstein/TWM Global Equity & Covered Call Strategy Fund | TWMLX |

| AllianzGI Structured Return A-Class | AZIAX |

| AllianzGI US Equity-Hedged - Institutional | AZUIX |

| AMG FQ US Equity - Institutional | MEQFX |

| Arin Large Cap Theta - Institutional | AVOLX |

| ASTON/Anchor Capital Enhanced Equity - Institutional | AMDSX |

| BPV Low Volatility | BPVLX |

| BPV Wealth Preservation Advisor | BPAPX |

| Bridgeway Managed Volatility | BRBPX |

| Camelot Excalibur Small Cap Income - Class A | CEXAX |

| Camelot Premium Return - Class A | CPRFX |

| Catalyst/Lyons Hedged Premium Return - A | CLPAX |

| Catalyst/MAP Global Capital Appreciation - A | CAXAX |

| Catalyst/SMH Total Return Income - Class A | TRIFX |

| Centaur Total Return | TILDX |

| Covered Bridge - Class A | TCBAX |

| Credit Suisse Volaris US Strategies - Class A | VAEAX |

| Crow Point Defined Risk Global Equity Income - Class A | CGHAX |

| Dividend Plus Income Fund - Institutional | MAIPX |

| Dunham Monthly Distribution Fund - Class A | DAMDX |

| Eaton Vance Hedged Stock - Institutional | EROIX |

| Frost Cinque Large Cap Buy-Write Equity - A | FCAWX |

| Gateway - Class A | GATEX |

| Gateway Equity Call Premium - Class A | GCPAX |

| Glenmede Secured Options | GTSOX |

| GMO Risk Premium - Class III | GMRPX |

| Hatteras Disciplined Opportunity - Institutional | HDOIX |

| Hussman Strategic Growth | HSGFX |

| ICON Risk-Managed Balanced - Class A | IOCAX |

| Investment Partners Opportunities - Class A | IPOFX |

| Iron Horse - Class A | IRHAX |

| Ironclad Managed Risk | IRONX |

| JHancock Redwood - Class A | JTRAX |

| KF Griffin Blue Chip Covered Call - Class A | KFGAX |

| Kinetics Multi-Disciplinary Advisor - Class A | KMDAX |

| KKM ARMOR A | RMRAX |

| KKM US Equity ARMOR A | UMRAX |

| Leigh Baldwin Total Return | LEBOX |

| LS Theta - Institutional | LQTIX |

| Madison Covered Call & Equity Income - Class A | MENAX |

| MD Sass Equity Income Plus Fund - Institutional | MDEIX |

| RiverNorth Managed Volatility - Class R | RNBWX |

| RiverPark Structural Alpha - Institutional | RSAIX |

| RiverPark/Gargoyle Hedged Value - Institutional | RGHIX |

| Russell Strategic Call Overwriting - Class S | ROWSX |

| Schooner - Class A | SCNAX |

| Swan Defined Risk - Class I | SDRIX |

| Touchstone Dynamic Equity - Class Y | TDEYX |

| Virtus Low Volatility Equity - Class A | VLVAX |

| WP Large Cap Income Plus - Institutional | WPLCX |

| YCG Enhanced | YCGEX |

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.