Payout Ratio

A company's payout ratio, or dividend ratio, is the percentage of the company's earnings used to pay out dividends to shareholders. It has many uses, including determining (1) if a company's dividend is sustainable, (2) if a company has the potential to invest in future growth, and (3) if a company has the potential to increase its dividend or perform a share buyback.

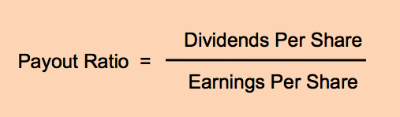

How Payout Ratio Is Calculated<

In it's simplest form, the ratio definition and calculation is:

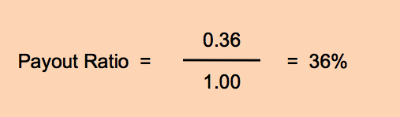

Payout Ratio Example<

For example, if a company had earnings per share of $1.00/year and paid a quarterly dividend of 9 cents, we would calculate a dividend ratio of 36% (since 9 cents/qtr = 36 cents/year dividend):

A 36% dividend ratio is comfortable for most companies. That means their dividend is safe even if earnings drop since they're only paying out roughly one third of their actual earnings.

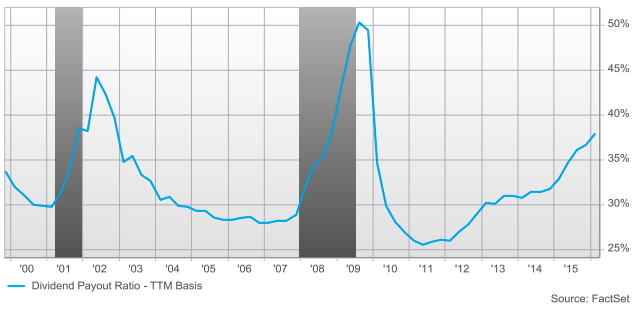

In fact, the current average S&P 500 payout ratio is around 38% on a trailing twelve months basis (with recessionary periods highlighted in darker grey):

Payout Ratio Over 100%<

Sometimes a company will have a dividend payout ratio over 100%. But that is not sustainable. That means one of two things (1) they are paying out more than they are earning (which they can't do for very long), or (2) they have high depreciation costs (which is a non-cash charge that affects earnings but not cash available for dividends).

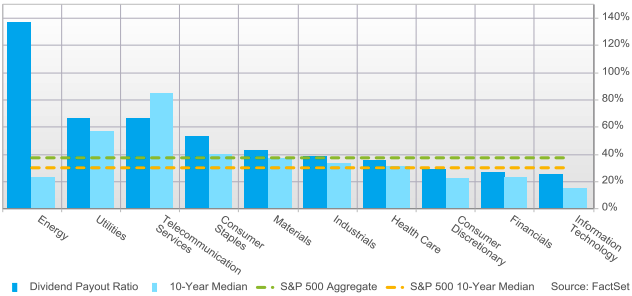

Payout Ratio By Industry Sector<

Typical payout ratios vary by industry sector. Some sectors, like utilities and telecom have a long history of high ratios while others, like technology, have a history of low ratios because they are reinvesting earnings to develop new products and fund growth.

The chart below shows ratios by industry sector. The light blue bars are the 10 year median payout ratios, while the darker blue are current dividend ratios. As you can see, the energy sector is temporarily above 135% (not sustainable -- either earnings will have to increase or dividends will be cut):

Payout Ratio Of Top Dividend Yield Companies<

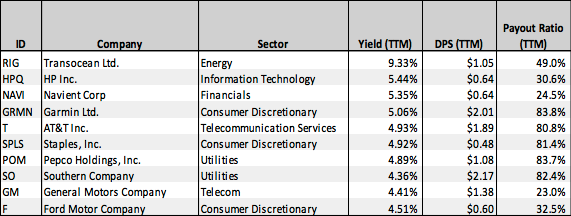

If we analyze the top dividend yield companies and remove ones that have payout ratios greater than 100% (not sustainable) and compare the remaining pay out ratios, we find dividend yields of 4.5% to 9.3% with ratios of 23% to 83% (DPS (TTM) = Dividends Per Share for last 12 months):

Half of that list has ratios > 80%. But analysis shows utility and telecom companies have a long history of ratios > 70%, so not too much to worry about for those companies. SPLS and GRMN, however, do give reason to pause and do additional research because of their high ratios (their dividends could be at risk of reduction if earnings do not improve).

Low Payout Ratio Stocks<

A payout ratio under 50% is considered low and is one of the most attractive attributes in a dividend stock. Presumably, shareholders of a dividend stock like the fact that it pays a decent dividend, and a low ratio gives confidence that the dividend won't be reduced (and/or likely to be increased in the future).

The ideal stock (for dividend safety) will have a high (or medium-high) dividend yield and at the same time have a low dividend ratio. Recently, Aaron Levitt of InvestorPlace screened for just such an animal, and found 7 that he believes meet the requirements and have room to grow. His results are:

Covered Calls On Low Payout Ratio Stocks<

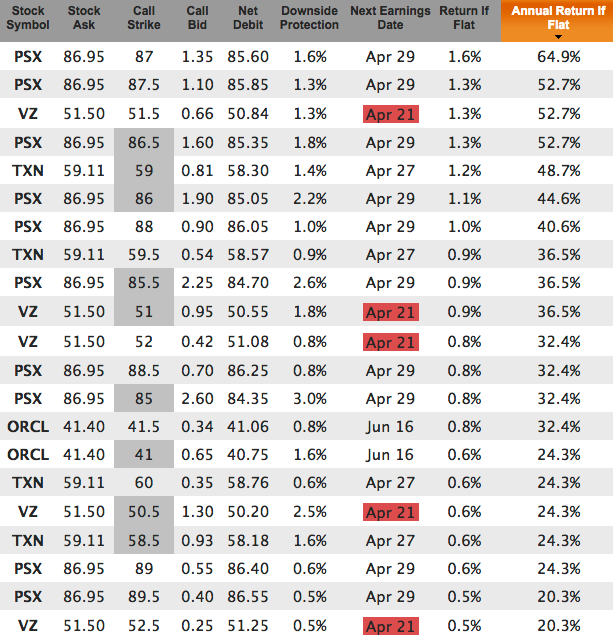

If we plug those 7 symbols into Born To Sell's covered calls screener, we find several opportunities for at-the-money covered calls over the next week (Apr 22 expiration):

From that list only VZ has an earnings release prior to the Apr 22 expiration. There are no dividends prior to Apr 22.

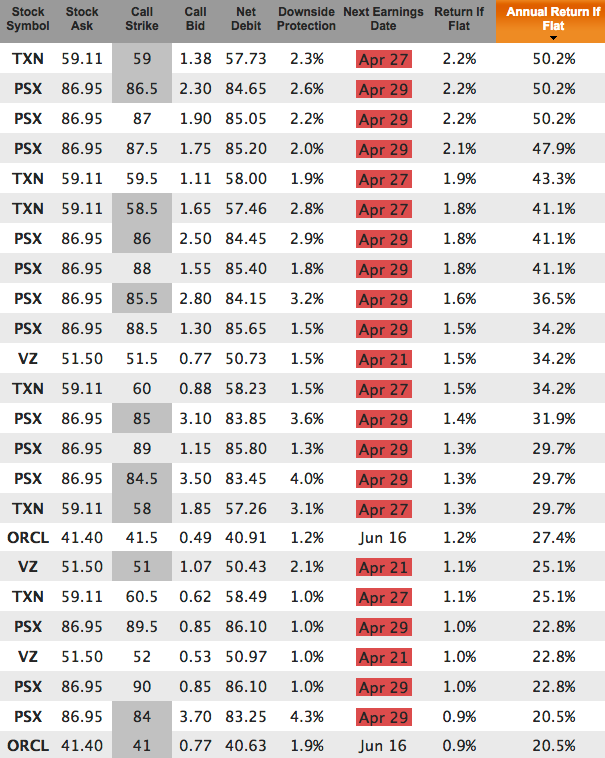

Going out a bit farther, to the Apr 29 expiration, we find that all but one (ORCL) has an earnings release before option expiration:

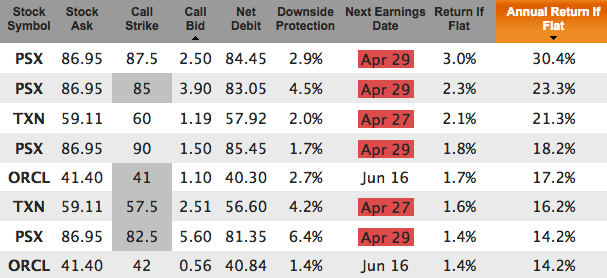

And, lastly, if we look to the monthly May expiration (May 20), there are fewer opportunities from this set of 7 stocks:

As always, these are not trade recommendations. They are covered calls on low payout ratio stocks identified by Aaron Levitt as good dividend candidates because of their relatively high yields and low ratios. Do your own analysis, stay diversified, and keep position sizes reasonable.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.