Reddit's Investment Club Income

Reddit is a popular social sharing, news, and discussion web site. Submitted stories are commented on and voted on by Reddit users to decide what moves up or down on the front page. They have sub-categories ("subreddits") for just about every special interest group (including investors) with discussion forums. The subreddit on investing contains an investment club that collectively manages an investment portfolio.

The Reddit Investment Club portfolio

The Reddit Investment Club manages a hypothetical $600K portfolio (click on Current Portfolio on the right hand side of the club's home page to see a spreadsheet with all the details). Currently, they are tracking $50K investments in each of 12 stocks: ADM, AGN, F, JPM, MBII, MCD, NSC, ORAN, SBAC, SLB, TLK, and TOT. Their original basis was $600K and today their positions are worth $780K. They are doing well, but they could be reducing risk and generating more income by using covered calls.

Improving Reddit's Income With Covered Calls

Let's copy the 12 symbols from the Reddit Investment Club portfolio spreadsheet and paste them into Born To Sell's Watchlist Symbols box and set the Expiration slider to June 21 (about 7 weeks from today):

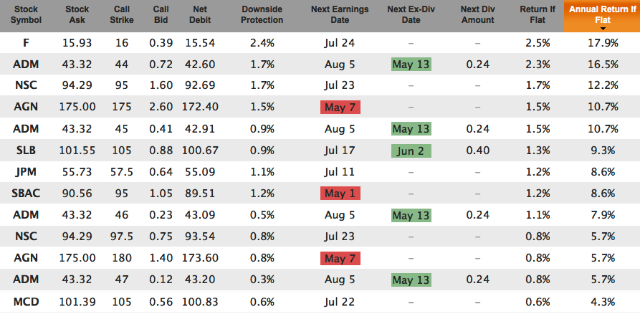

Set the Moneyness filter to "at the money or higher" strikes, and we get several possible covered calls to write:

Assuming the Reddit investment club wants to sell at-the-money or slightly out of the money options, the way to maximize time premium capture with this portfolio is to sell the following June call options (note we aren't covering ORAN or TLK because the June options don't pay enough to make it worthwhile; one could make the same argument for MCD but we decided to leave it in since it's 3.5% out of the money):

| Symbol | Price | Shares | Contracts | Strike | Call Bid | Income |

|---|---|---|---|---|---|---|

| ADM | 43.32 | 1829 | 18 | 44 | 0.72 | 1296 |

| AGN | 175.00 | 557 | 5 | 175 | 2.60 | 1300 |

| F | 15.93 | 4000 | 40 | 16 | 0.39 | 1560 |

| JPM | 55.73 | 879 | 8 | 57.5 | 0.64 | 512 |

| MBII | 13.45 | 3684 | 36 | 15 | 0.35 | 1260 |

| MCD | 101.39 | 523 | 5 | 105 | 0.56 | 280 |

| NSC | 94.29 | 712 | 7 | 95 | 1.60 | 1120 |

| SBAC | 90.56 | 749 | 7 | 95 | 1.05 | 735 |

| SLB | 101.55 | 666 | 6 | 105 | 0.88 | 528 |

| TOT | 70.86 | 918 | 9 | 72.5 | 0.55 | 495 |

| Total -> | 9086 |

Income of $9086 in 7 weeks on a portfolio of $780K (not including dividends), works out to 1.16%. Repeat that process 6 times per year and you could get 7% per year from out of the money call premiums on this portfolio. Add in dividends and a little bit of upside potential (since most of these are a little bit out of the money) and you're on your way to 10%+ return for the year. Not bad for a portfolio that wasn't originally chosen for its call-writing attractiveness.

If any of these options finish in the money on expiration day then the club could make a decision to let them get called away (and reinvest the money somewhere else) or to roll them out to a farther date (and/or strike price). Some would argue you're giving up too much upside potential by writing these calls, but that is the nature of covered call writing -- take $9K in premium every 7 weeks as downside protection, increased income, and risk reduction.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.