Sell (Call Options) In May And Go Away

Sell (Call Options) In May And Go Away

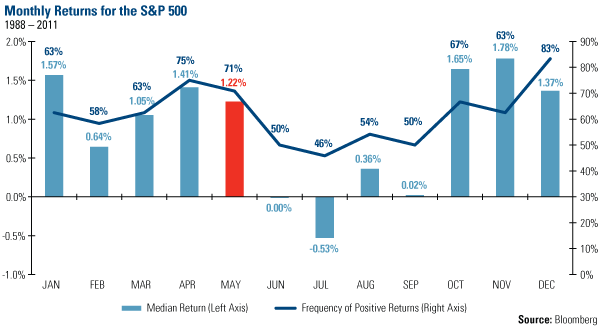

The expression Sell In May And Go Away has its roots in the historical returns for the summer months, which have lower average monthly return than the rest of the year. This chart from Bloomberg illustrates the pattern over a 23 year span:

While May itself isn't so bad, it's the 4 months that follow it that people are freaked out about (Jun, Jul, Aug, Sep). So what is a covered call writer to do?

Sell Call Options In May That Expire In Late Summer

One way to go about it is to sell in-the-money call options against your positions with an expiration date sometime in the summer. That way if the stocks are flat or go down a bit during the summer you will have at least collected the time premium of the options, as well as enjoyed the downside protection from the intrinsic value that in-the-money options offer. You could make money even if the stocks drop over the summer (as long as they don't drop by more than the option premium you receive).

Examples Of 3 And 4 Month Covered Calls

While it is true that the sum of several short-term option premiums is greater than a single longer-term option premium (because of the time decay curve of options), the intrinsic value offered in short-term options is smaller than longer-term options with a similar annualized return. In order to have more "forget" (i.e. you won't freak out about every small drop in the underlying stock) we're going to look at deeper in-the-money situations on longer dated options.

Imagine you have stocks that have appreciated recently (but you don't want to sell them for whatever reason) and you want to "go away" after you've written an in-the-money call on them (i.e. forget about the trades for several months). Not every stock trades a September expiration yet, so here are a few ideas for Aug and Sep expirations:

| Symbol | Stock Price |

Expiration | Strike | Call Bid | Net Debit | Annualized Return |

|---|---|---|---|---|---|---|

| AAPL | 569.48 | Aug 18 | 560 | 46.30 | 523.35 | 24.8% |

| CRM | 151.98 | Aug 18 | 130 | 28 | 123.98 | 17.4% |

| LNKD | 111.66 | Aug 18 | 90 | 25.70 | 85.96 | 16.7% |

| CRUS | 25.94 | Sep 22 | 21 | 6.30 | 19.64 | 18.3% |

| GOOG | 569.48 | Sep 22 | 600 | 41.60 | 566.30 | 15.9% |

| VHC | 31.25 | Sep 22 | 23 | 9.90 | 21.35 | 20.4% |

If you sell these options then your break-even point is the Net Debit (stock price minus the call premium). For example, you could buy AAPL at 569.48 and sell an Aug 18 expiration 560-strike for 46.30. As long as AAPL is above the net debit (523.35) on Aug 18 you've come out ahead.

Because they are 3 or 4 months out, all of these have an earnings release due before option expiration. But they all offer downside protection and time premium income.

If you want to wait out the summer months without selling your whole portfolio, try looking into some end-of-summer expiration dates for in-the-money covered calls. Yes, you forfeit any capital appreciation upside and, yes, this is an election year, but there are also many reasons to be cautious right now. It might not be a bad thing to have some protection.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.