January Short Squeeze Potentials

End of year is an interesting time for investors. Most people try to balance their gains and losses for the year to minimize their capital gains tax and ordinary income tax. For many reasons, some investors will wait until early January to take gains. This creates an opportunity for a certain class of stocks.

Short sellers have done well in some stocks this year. They may be sitting on unrealized profits they want to wait until 2021 to realize. If many of them try to cover (i.e. buy shares to close out their short position) at the same time then there is a short squeeze possibility.

Beaten Down, Heavily Shorted Stocks

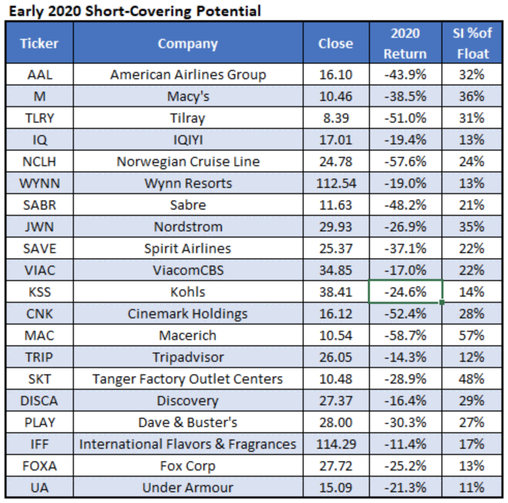

How to find these companies? Schaeffer’s has done the work. They made a list of 20 companies who have fallen at least 10% in 2020, and who also have at least 10% of their float sold short. These beaten down, highly shorted stocks could get a boost in the first week of January from short covering. You can read their analysis here, and see their results here:

Many of these beaten down stocks are Covid related (airlines, cruises, retail) that might do better once Covid is less of an issue than it is today.

Covered Calls On Heavily Shorted Stocks

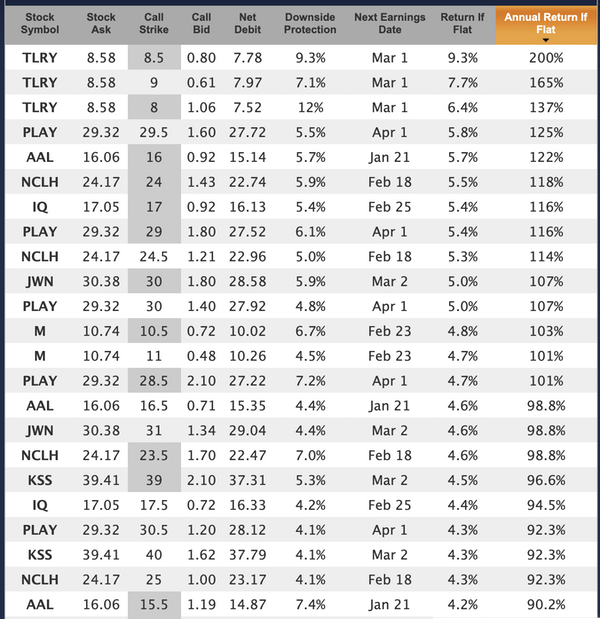

We plugged those symbols into Born To Sell’s Watchlist and set the expiration date to Jan 8 (about a 2 week trade that covers the frist week of the new year). Here are the results that have 90%+ Annualized Return If Flat (arbitrary cutoff to keep the data shown reasonable here; more choices are available in the screener):

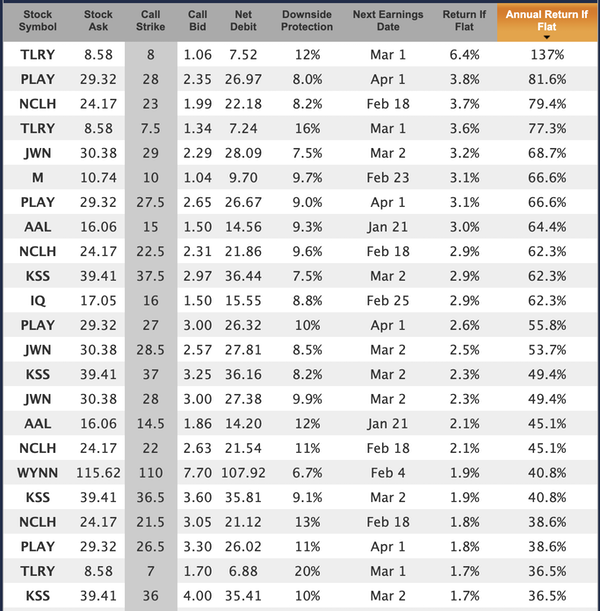

There are a few in-the-money options in that list, but if we limit results to only covered calls that are 5% or more ITM, here are the results with an ARIF greater than 36%:

Many of those have Downside Protection around 10%, meaning the underlying would have to drop by more than that amount (from today) before you'd start to lose money. Also, not shown is the fact that none of these have an earnings date or ex-dividend date before Jan 8.

These are not trade recommendations. But these are candidate trades starting from Schaeffer’s list and layering on covered calls. Do your own homework to see if any of these are right for your portfolio.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.