Van Hulzen Interview

Outperforming the market over a year is a nice accomplishment. Outperforming it consistently for 11 years is outstanding. That's what Van Hulzen Asset Management has done with their covered call strategy.

Recently, Born To Sell interviewed these professional money managers to gain some insight to their market-beating strategy. Here's what they had to say...

BTS (Born To Sell): We're speaking with Craig Van Hulzen, John Pearce, and Stefan ten Brink at Van Hulzen Asset Management, the firm that manages the Iron Horse Fund (ticker IRHAX), an actively managed covered call fund. To start off, tell us about your track record.

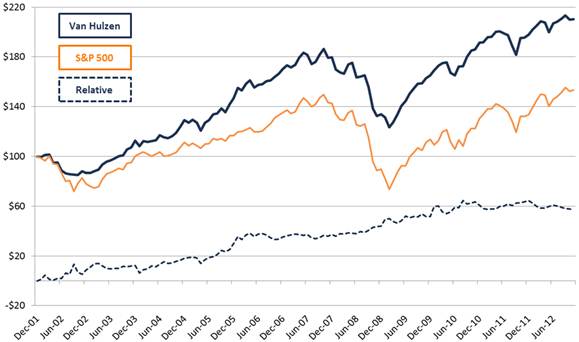

CVH (Craig Van Hulzen): Well, the Fund has only been live for 18 months, but we have managed our covered call strategy in SMAs (separately managed accounts) for nearly 11 years. We have been investing in conservative portfolios using covered calls that entire time. Currently, Van Hulzen Asset Management has over $300 million in assets under management. We've outperformed the market by an average of 3.2% per year over the past 11 years. This graph compares us to our benchmark, the S&P 500:

BTS: Nicely done. How much of that performance is from the call premium?

CVH: About 3-4% of our annual return is from call premium. We try to have a balance between income (dividends and call premium) and growth (capital appreciation).

BTS: Since you beat the market by an average of 3.2% per year and since you're earning 3-4% in call premium per year, it looks like almost all of your market-beating performance can be attributed to the call premium.

CVH: Exactly. And we did it with only 60-70% of the volatility of the S&P 500 thanks to the call premium.

BTS: What are the basic guidelines you use to manage your fund?

CVH: We're targeting a certain risk profile: investors who want to beat the market but do so at lower risk. We also believe in educating our clients as to how we do it, so we spend a lot of time explaining how covered calls work so they know what they are getting into. We are a total solution provider for high net worth individuals.

As for the investments themselves, we aim for a balance of income and capital gains, trying to get 50% of our total return from income (dividends and call premium) and 50% from growth in the underlying stocks.

BTS: So all of your stocks are dividend payers?

CVH: The majority are, yes. Across the portfolio our dividend yield is around 3%, whereas the S&P 500 is around 2% today, so we have an above-market yield. We stick with the mega cap, blue chip, quality companies.

BTS: When looking for a new investment, do you use fundamentals, technical indicators, juicy call premiums, or something else?

CVH: We use fundamentals. We perform proprietary research and analysis that tells us what the companies should be selling for. We like to buy them at a discount to what we believe their fair value is, and then sell call options with strike prices equal to what we feel their fair value is. But we only buy stocks we're happy owning for the long term.

BTS: So you're writing out of the money options?

CVH: Yes. Often the strikes are 10% out of the money, with an average age to expiration of about 7 months. In some cases we'll do shorter term, lower strikes, but we're not here to trade weeklys. In some cases we might even have to go out a year on the expiration date, if it's one of our less volatile stocks. We don't sell options that are only 5 or 15 cents.

BTS: Do you ladder your positions, choosing different strikes or expiration dates for the same underlying stock?

CVH: Yes. In our business where new money is coming in at random intervals, we are constantly buying more stock. Since we build positions over time as the fund grows, we end up with a variety of strike prices and expiration dates for the same symbol. That can actually be useful at the end of the year in terms of taxes because we can decide which lots to let go and which to keep to minimize the tax hit for our clients.

BTS: What percent of your covered calls end up in the money vs out of the money?

CVH: About 70-80% expire out of the money. If it's in the money on expiration day we'll ask ourselves if we still like the fundamentals enough to buy back the call option and sell another one with a higher strike. But it's good discipline to sell some of your winners once in a while, so sometimes we let them get called away if they've had a nice run.

BTS: Do you sell any naked puts? Or buy any puts for protection?

CVH: No. It's just covered calls in the Fund. For some of our separately managed accounts we may use puts. It depends on the individual investor and what their needs and goals are.

BTS: How many positions do you have in the Iron Horse Funds at any given time?

CVH: 40 to 50. By design we're not allowed to have any single position larger than 5% of the fund. And for us a 3% position would be a large position. We keep it well diversified.

BTS: Do you initiate any new positions just before earnings announcements to take advantage of the fat premiums?

CVH: No. There's too much volatility and squirreliness around earnings to initiate a new position in the fund. This is a conservative portfolio.

BTS: Have you taken any special actions recently because of fiscal cliff concerns?

CVH: No. We believe there will be a deal of some kind that gets done. Haven't had any major changes in the portfolio because of cliff concerns.

BTS: What about Apple? What's your view given the recent drop from 700 to nearly 500?

CVH: We like AAPL but have it underweighted in the portfolio relative to the index. We think there's been a lot of tax loss selling. It doesn't look expensive any more at 11x earnings. That's an example where we'd write shorter duration calls and at lower strikes, since the premiums are so rich. With AAPL in the low 500s we'd write 2 month calls with strikes that are 30-40 points out of the money. That's not typical of what we do in the fund and, as I mentioned, it's underweighted for us in the fund.

BTS: Great. Thanks for your time today, guys.

For more information on this actively managed covered call fund, please visit Iron Horse Funds or contact Van Hulzen Asset Management.

Disclosure: This is not an endorsement to buy or sell securities. Investing in securities carries with it very high risks. The information contained within this interview is for informational purposes only and is subject to change at any time. Do your own due diligence and consult with a licensed professional before making any investment. Born To Sell has no affiliation nor has received any compensation from anyone or any company mentioned in this interview.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.