Weekly Dividend Income For Oct 10 Expiration

Weekly Dividend Income For Oct 10 Expiration

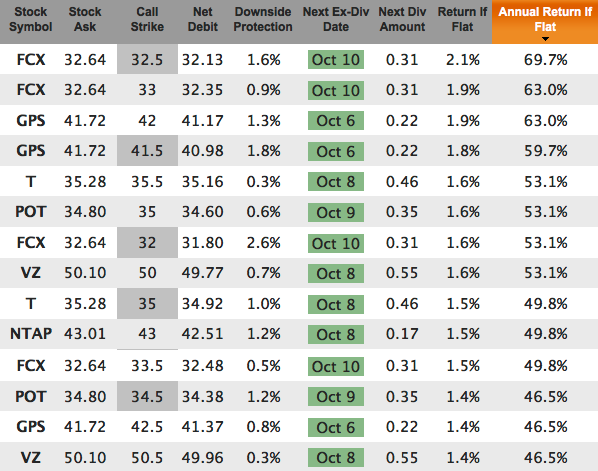

There are 6 companies going ex-dividend before the Oct 10 weekly expiration that offer covered call annualized returns of 46% or more when you consider the dividend income plus the call premium. They are: FCX, GPS, NTAP, POT, T, and VZ. The highest yielding covered calls (including the dividends) for these 6 companies are:

One risk reducer is that none of them have an earnings announcement before the Oct 10 expiration. However, some of them are out-of-the-money.

To reduce risk and find only in-the-money covered calls, we paste those 6 symbols into the Watchlist Symbols box and set the Moneyness filter to 1% or more in-the-money:

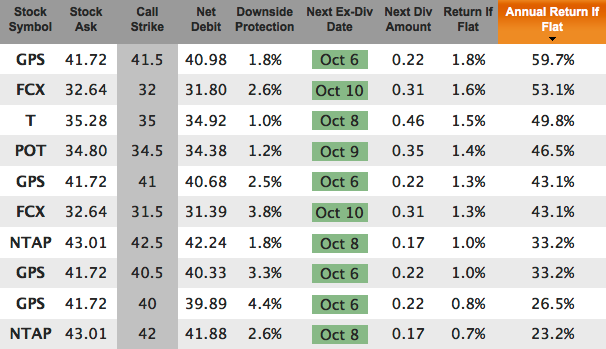

We then get:

The first 4 of these are in the previous results, but the next 6 are deeper in the money choices. They have higher Downside Protection at the expense of lower Annualized Return.

As with all screens, these are not trade recommendations. They are just ideas to begin your own due diligence. If you're going to implement a dividend capture strategy using covered calls, you can reduce risk by doing your homework before investing, staying diversified, using appropriate position sizes, and looking for deeper in the money situations.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.