Buy And Hold vs. Covered Call: Caterpillar

George Acs published an article on TheStreet.com today called Caterpillar Is My Annuity. In the article he states that over the last 18 months he earned 47.5% more than a buy-and-hold investor in the same stock:

| 18-month Strategy | Return |

|---|---|

| Buy and Hold CAT | 5.2% |

| Dow Jones Industrial Average | 22.3% |

| Covered Calls on CAT | 52.7% |

Wow! How Did He Do It?

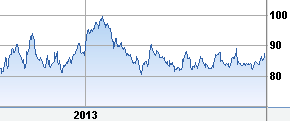

George says that he wrote covered calls on CAT during the last 18 months on 15 different occasions, with an average holding period of 39 days (sometimes holding different lots at the same time). Here's what the stock has done for the last 18 months:

In hindsight that chart looks perfect for covered call writing. Just buy the dips in the low to mid 80s and write ITM or slightly OTM covered calls on it. Will it continue going sideways for the next 18 months? Don't know.

How He Got 52.7% In 18 Months

George didn't break out his return by component type: (1) stock appreciation, (2) dividends, and (3) call premium. But we know his average holding period was 39 days. If we assume he was writing slightly out of the money calls (say 1% out of the money) when CAT had a dip, and then had his stock called away 39 days later, then we can attribute 15% of his gain (1% times the 15 holding periods he said he had) to stock appreciation. We can also allocate about 4.2% of his gains over 18 months to CAT's 2.8%/year dividend.

That leaves 33.5% due to call premium over 15 trades, or an average premium per trade of about 2.2%.

January Options Expire In 32 Days

The Jan 18 expiration date is 32 days from today, a bit shorter than George's average of 39 days but let's work with it.

CAT closed at 86.92 today. The nearest slightly out of the money strike is 87.5, and the January 87.5s are bid at 1.37, yielding these returns:

| Symbol | Exp Date | Strike | Return If Flat |

Return If Called |

|---|---|---|---|---|

| CAT | Jan 18, 2014 | 87.5 | 2.3% | 2.9% |

As a reminder, Return If Flat means the stock is the same price at expiration as it is today (so, in this case the option would not be exercised since the strike is above the current price), and Return If Called means the stock is above the strike price on expiration day and is called away at 87.50/share. (Born To Sell's tutorial has a section on calculating covered call returns.)

So, is this a good time to put on a CAT covered call? Like all trading (and since we don't give trade recommendations), you'd have to do your own diligence on that. But what is true is that the premiums on the Jan 87.5 calls on CAT support a return profile like George's, at least for the next 32 days. CAT may not have kept up with the market's gains over the last 18 months but smart investors like George are using covered calls to take advantage of the situation.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.