Covered Call Calculator

A good covered call calculator will help you answer the question "should I roll my position?" for an existing covered call position. When rolling you will want to consider important variables like: the bid/ask spread, time premium remaining, earnings release dates, and ex-dividend dates. Your covered call calculator should include all of these.

What does rolling a covered call mean?

Rolling a covered call position means you buy back the option portion of the position and then sell a different option (either a different strike, or expiration month, or both). Because options have bid-ask spreads you will need to consider that you have to pay the 'ask' when you buy back the existing option, and you receive the 'bid' when selling the new option (you may do slightly better with limit orders that split the bid/ask but most calculators will assume you pay the ask and receive the bid so that they give a result that you could actually achieve).

Example of rolling a covered call

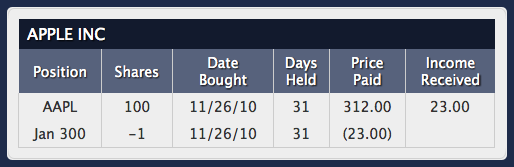

Let's imagine you have 100 shares of AAPL that you purchased a month ago for $312/share. And let's imagine you sold a January 300 call option for 23 that same day. This is your situation today (Dec 27):

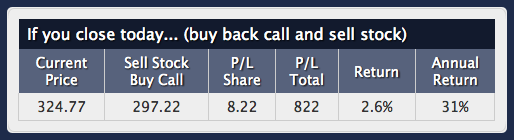

It has been a month since you made that investment. During that time AAPL has gone up (now at 324.77) and the call has lost time premium (which is good for you). If you were to close today, this is your situation:

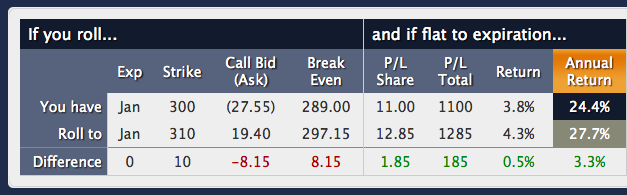

So you would make money if you closed it out today. However, there is a way to increase the profit on this trade even more... by rolling the trade to a higher strike. Because AAPL has an earnings release during the Feb option cycle you may not want to roll out to Feb. But you could roll up to the 310 strike (from the 300 strike you have today) since your option is now deep in the money. You would do this by buying back the Jan 300 option and then selling the Jan 310 option. Your covered call calculator should show you the difference like this:

The top rows shows that you will have to pay $2755 to buy back the Jan 300 option, and then on the middle row it shows that you will receive $1940 for the Jan 310 option. The bottom row shows that this rolling will cost you $815 since the option you are buying (Jan 300) costs more than the option you are selling (Jan 310) but your overall profit is increasing by $185 (as long as AAPL stays above 310 by expiration) because you are raising the strike price by 10 points (300 -> 310).

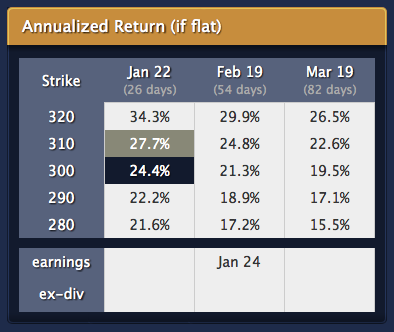

Ideally, your covered call calculator will let you compare many different options at the same time, and also warn you about earnings release dates and ex-dividend dates within each option cycle (this particular calculator, which is Born To Sell's Roll Me calculator, is interactive -- your current position is in dark blue and the one you're comparing against is in grey; and you can click on any cell to compare against a different option):

Using a covered call calculator that has automatically updating prices, integrated earnings release dates, and ex-dividend dates is a huge time saver. This kind of calculator will help you optimize the time premium you receive each month, as well as keep you out of trouble by keeping you aware of important dates. The old way of using a spreadsheet with incomplete and non-updating information typically leads to sub-optimal results.

Want a good covered call calculator? Check out our Covered Call Screener

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.