Reducing Covered Calls Risk

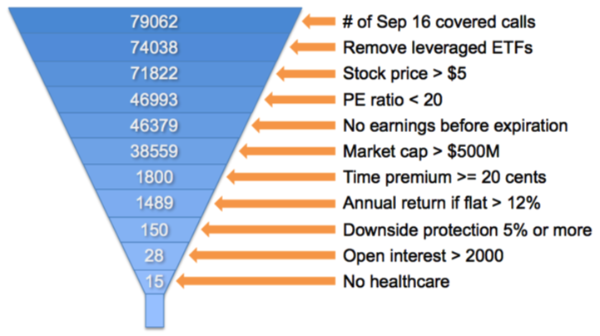

There are several ways to reduce risk in covered call trading, and yet still make good monthly income. In this article we start with 79,062 covered call candidates for the September 16, 2016, expiration and show how to reduce that set to 15 lower-risk covered calls that still have an average annualized yield of 48%.

Covered Call Risk

Like all investment strategies, you can choose to do covered calls in a conservative manner, or an aggressive manner. Conservative covered call investors choose stocks that are not super volatile, and stay away from things like earnings dates or FDA announcements. They seek large cap, dividend paying, blue chip stocks. And they don't trade on margin.

Aggressive covered call investors do the opposite… they seek stocks that have options with the highest possible premiums without regard for why those premiums are so high (eg. expected product announcement, or FDA announcement, or M&A rumors, or earnings announcements, etc). They trade on margin, and they trade thinly-traded option series (low open interest makes for wide bid-ask spreads and makes it costlier to do adjustments to the position should the need arise).

The Universe Of Covered Calls

Today, September 2, 2016, there are 421,834 covered calls available. That includes all strikes, all expiration dates, and all stocks and ETFs that trade on US exchanges.

Of the 4,445 underlying symbols, 3884 are stocks and 561 are ETFs (exchange traded funds, which are typically baskets of stocks like mutual funds).

If we look at the number of covered calls offered by expiration date (that is, all symbols and all strikes for a given expiration date), we find:

Expiration Date |

Days Until Expiration |

Unique # of Covered Calls |

|---|---|---|

| Sep 2, 2016 (weekly) | 0 | 21855 |

| Sep 9, 2016 (weekly) | 7 | 21348 |

| Sep 16, 2016 | 14 | 79062 |

| Sep 23, 2016 (weekly) | 21 | 19606 |

| Sep 30, 2016 (weekly) | 28 | 17595 |

| Oct 7, 2016 (weekly) | 35 | 16620 |

| Oct 21, 2016 | 49 | 63234 |

| Nov 18, 2016 | 77 | 22790 |

| Dec 16, 2016 | 105 | 30639 |

| Jan 20, 2017 | 140 | 43675 |

The 5 rows marked "(weekly)" are weekly options. The number of covered calls offered is less for weekly options than for monthly options because not all underlying stocks and ETFs trade weekly options. In fact, only 476 of the 4,445 optionable symbols trade weekly options. But they are most heavily traded 476 stocks and ETFs so chances are good that weeklys will be available for stocks you are most interested in. (By the way, weekly options are the same as monthly options except that most of them have fewer days until expiration. They expire every Friday for the nearest 5-6 Fridays, while monthly options expire on the 3rd Friday of the month and are available every month for at least 12 months.)

Open Interest

"Open interest" is the number of contracts that exist for an option series. If you want more liquidity and tighter bid-ask spreads then more open interest is better. If we look at the sum of open interest by expiration date, we can see there is more interest in the monthly options than the weekly options:

Expiration Date |

Sum of Open Interest |

|---|---|

| Sep 2, 2016 (weekly) | 4.6M |

| Sep 9, 2016 (weekly) | 2.2M |

| Sep 16, 2016 | 30.9M |

| Sep 23, 2016 (weekly) | 2.0M |

| Sep 30, 2016 (weekly) | 2.3M |

| Oct 7, 2016 (weekly) | 0.4M |

| Oct 21, 2016 | 15.7M |

| Nov 18, 2016 | 6.4M |

| Dec 16, 2016 | 9.0M |

| Jan 20, 2017 | 44.1M |

Reducing Risk

Now that we've established how many covered calls there are, and seen what kind of open interest there is by expiration date, let's find some ways to reduce covered call risk.

Start With 79,062 Choices

Let's focus on the Sep 16, 2016, expiration date where there are 79,062 different covered calls offered (all symbols and all strikes), and they have a combined open interest of 30.9M contracts right now. All of these options expire in 2 weeks.

Remove Leveraged ETFs

Not all ETFs are created equal. Some of them are designed to have 2x or 3x the daily movement of some other ETF or index. These are called leveraged ETFs. For example, NUGT is a 3x leveraged ETF designed to have 3x the movement of the NYSE Arca Gold Miners Index. If you want to make a short-term directional bet on the gold miners index then NUGT may be for you. But it is not good for covered calls.

The first thing we want to do is eliminate leveraged ETFs from the 79,062 covered calls. Turns out there are 5024 of them, leaving us with 74,038 covered calls to choose from.

Remove Low Price Stocks

It's really hard to make money in covered calls with very low priced stocks. Plus, the low price stocks are subject to more manipulation than higher priced stocks, and they can be quite volatile. If we define "low price" as $5/share or less, then we find there are 2216 covered calls in this range. Removing them leaves us with 71,822 covered calls.

Remove High PE Stocks

It can be tempting to invest in high-flier momentum or high PE (price/earnings) type stocks. They can make you a lot of money quickly as long as their growth and momentum doesn't stop. These stocks often trade at very high PE multiples but once their balloon is pierced and the market starts to value them more like other companies, their stock price can come down in a hurry. Examples include NFLX with a PE of 295, or AMZN with a PE of 187. These are good companies, to be sure, but consider that the average S&P 500 stock has historically traded at a PE of 15.

Turns out that 1311 underlying symbols have a PE > 20, and they represent 24,829 of our remaining covered call candidates. By removing these high PE stocks we're left with 46,993 options.

No Earnings Before Expiration

Earnings release dates are high volatility events and any option for an underlying stock that has an earnings release between today and expiration will be priced for earnings volatility. It may be tempting to sell these fat-premium options as part of a covered call but if the underlying stock makes a 10% move downward you are likely going to regret it. There's just too much risk around earnings for the typical covered call investor, so let's remove them.

There are 43 companies that have an earnings release before our chosen expiration date of Sep 16, 2016. They represent 614 covered calls. Remove them and we're left with 46,379 covered calls.

Remove Small Companies

Companies that have market capitalizations (aka 'market cap') of less than $500M are volatile. Many of them are new issues (recent IPOs), and the others have small enough market caps that a single investor can move the stock up or down.

There are 559 companies in our remaining set that have market caps of less than $500M, representing 7,820 covered calls. Remove them and we have 38,559 covered calls.

No Tiny Time Premium

Because of commissions and trading slippage, we don't want to waste our time with options that have little tiny time premium, such as less than 20 cents. If you are trading tens of contracts at a time then you might be able to relax this rule, but we're going to eliminate the 36,759 covered calls that offer less than 20 cents of time premium, leaving us with 1800 covered calls.

Remove Low Annual Return

Ideally, we would like to have at least 1%/month (12%/year) return in order to make our covered call investing profitable. If you're writing out of the money covered calls just to get some extra income from stocks you are hoping not to have called away then you can relax this rule a bit. But for our purposes, we're going to remove the 311 covered calls from our set of 1800 that offer annualized returns < 12%. We are now left with 1489 covered calls.

In The Money and Downside Protection

A call option is called "in the money" if the strike price is below the stock price. These options are likely to be called away if they are short term and there are no volatility events before expiration. "Downside protection" is a combination of moneyness (how far something is in the money) and time premium. It measures how much the underlying stock would have to fall before we'd experience a loss. Some of the fall is protected by intrinsic value (since the option is in the money) and some is protected by the amount of time premium we received when selling the option.

For our purposes, we're going to reduce our set to only those covered calls that have at least 5% downside protection. This reduces our set to 150 covered calls.

Higher Open Interest

As mentioned earlier, more open interest is better than less. It makes for more liquidity and tighter spreads, both good things. If we look at our 150 covered call set we see that many have very small open interest. Not good for us. Let's limit the set to only those with an open interest of 2000 contracts or more. There are 28 of these.

No Healthcare

Healthcare stocks are very volatile around FDA announcement time. That's when the FDA either approves or denies a company's new drug, device, or therapy for treatment on humans. Stocks can double or be cut in half, depending on how the FDA rules. These kinds of high volatility events are not good for covered call investors (too risky). So, we're going to remove all healthcare stocks from our set of 28, leaving us with 15:

The Final 15

Well, started with 79,062 covered call candidates and, by removing various risk elements, ended up with these 15:

Symbol |

Stock Ask |

Strike |

Call Bid |

Net Debit |

Annualized Return |

|---|---|---|---|---|---|

| AAL | 36.55 | 35 | 1.85 | 34.70 | 22% |

| ABX | 18.20 | 17.50 | 0.98 | 17.22 | 39% |

| CDE | 13.53 | 13 | 0.85 | 12.68 | 61% |

| CHK | 6.61 | 6.50 | 0.42 | 6.19 | 122% |

| GDX | 27.33 | 26 | 1.63 | 25.70 | 29% |

| MRO | 15.50 | 15 | 0.79 | 14.71 | 49% |

| PAAS | 18.90 | 18 | 1.15 | 17.75 | 34% |

| SCOR | 31.80 | 30 | 2.20 | 29.60 | 34% |

| SPWR | 10.32 | 10 | 0.58 | 9.74 | 66% |

| SVXY | 75.92 | 70 | 6.60 | 69.32 | 24% |

| TWLO | 57.70 | 55 | 3.50 | 54.20 | 37% |

| TWTR | 19.54 | 18.50 | 1.36 | 18.18 | 44% |

| TWTR | 19.54 | 19 | 1.05 | 18.49 | 68% |

| UAL | 51.05 | 48 | 3.30 | 47.75 | 12% |

| WLL | 7.39 | 7 | 0.60 | 6.79 | 75% |

How To Read This Chart

The above is a list of 15 covered calls. These are not trade recommendations. These are merely the covered calls for the Sep 16, 2016, expiration that survived our risk-reduction filters. You should never rely solely on filtered results to invest; always do additional due diligence before investing.

Net Debit is your total cash outlay (per share) to enter one of these trades. For example, if you buy 100 shares of AAL at 36.55 and sell 1 Sep 16 expiration, 35-strike, call option for 1.85, your out of pocket cost (net debit) is 34.70 per share. On Sep 16 if AAL is above 35 then you will receive $35/share in cash and have made 30 cents on a $34.70 investment in 14 days, for an annualized return of 22%.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.