Improved Dogs Of The Dow Strategy

Improved Dogs Of The Dow Strategy

The Dogs Of The Dow strategy is a conservative, value, and income-oriented strategy that involves buying and holding the highest yielding Dow 30 stocks. Fans of the strategy make portfolio adjustments once per year, making sure their holding period is 366 days or more so that they get long term capital gains treatment.

It Has A Strong History

Historically, it has been a winning strategy, beating the market in several time frames (see last year's Dogs Of The Dow article). This year, we look at a possibly improved version of the strategy where you buy the top 5 dogs (i.e. the top 5 highest yielding of the 30 Dow stocks) and write covered calls against them (you can read justification for these 5 stocks at 5 'Dogs of the Dow' to Buy in 2014.

Top 5 By Dividend Yield

| Company | Symbol | Dividend Yield |

|---|---|---|

| AT&T | T | 5.2% |

| Intel | INTC | 3.5% |

| McDonalds | MCD | 3.3% |

| Chevron | CVX | 3.2% |

| Cisco | CSCO | 3.1% |

Combining the Dogs Of The Dow strategy with a covered call strategy appeals to income-oriented investors. By selling out of the money call options against their positions they get extra dividends from these already high-yielding stocks.

Most of the so-called "dogs" are not high flying momentum stocks, so you may have to write options longer dated than near-month to get enough premium to make it worthwhile. But, since these are buy-and-hold positions, the low maintenance of multi-month contracts can be a plus a well.

Improving Dog Yield With Covered Calls

If we run these 5 high yield stocks through Born To Sell's covered call screener to find some buy-write candidates for the February 22 expiration (a bit less than 2 months from today). Since we plan to hold these beyond the expiration date, we'll look at options that are at least 2% out of the money.

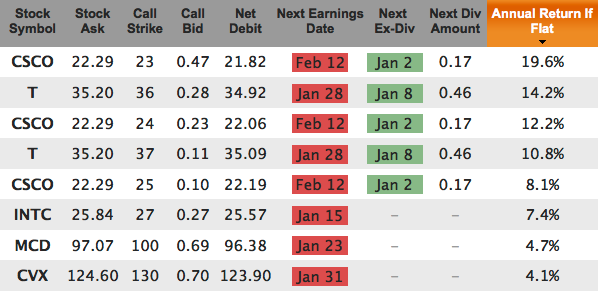

Here are the top results when sorted by Annualized Return If Flat (meaning the stock price is unchanged between today and expiration) for the Feb 22, 2014, expiration:

The red dates are warning us that there are earnings announcements prior to the option expiration day (Feb 22). The green dates are telling us that there is an ex-dividend date prior to the option expiration day (and, yes, the return calculations do include the dividend payment along with the option premium).

Two stocks (CSCO, T) have multiple strikes in the above table and, not surprisingly, the closer to the money options have a higher yield. For example, compare CSCO's 23-strike with 19.6% annualized return if flat to the 24-strike at 12.2%, or 25-strike at 8.1%. It comes down to personal preference. If you are more risk averse you would choose the lower strike. If you want more upside potential then choose the higher strike. There is no single "best" answer for everyone because not everyone shares the same risk profile or portfolio characteristics. But no matter which strike or expiration date you choose, writing covered calls against these high yielding "dogs" will increase their yield and lower your portfolio volatility.

Also, note that the above table consists of options that have a life of less than 2 months, and that are out of the money (the strike is higher than the stock price). The return numbers shown assume the stock price is the same at expiration as it is today. In reality, stock price will move around (up and down) and you will likely sell another out of the money option against the same stock position after the February options expire (even if you have to buy back the Feb options prior to expiration because they are in the money).

So the returns shown do not reflect what would happen after 6 premiums (one every 2 months) or several dividends (one every quarter) have been collected. Impossible to estimate your total return for the year but it is likely that the 6 option premiums will at a minimum double the current dividend yield.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.