9 Goldman Picks For 2019

"We expect investors will soon look past 2018 and focus on 2019 growth," says Goldman Sachs strategist David Kostin. "For many years, beginning in July investors would start to value stocks based on the following year's profit outlook."

Wall Street is modeling 2019 S&P 500 sales growth of 5% but, Goldman's new "high revenue growth stock basket" could notch sales growth of several times that in 2019.

The 9 stocks on Goldman's Hot List for 2019 are: ALGN, AMZN, ADSK, COG, CXO, FB, NFLX, PNR, and VRTX.

Goldman's 2019 Revenue Growth Estimates

| Name | Symbol | Goldman's Revenue Growth Estimate |

|---|---|---|

| Align Technology | ALGN | 22% |

| Amazon | AMZN | 22% |

| Autodesk | ADSK | 27% |

| Cabot Oil & Gas | COG | 34% |

| Concho Resources | CXO | 30% |

| FB | 27% | |

| Netflix | NFLX | 25% |

| Pentair | PNR | 22% |

| Vertex Pharmaceuticals | VRTX | 22% |

"Firms with high revenue growth should outperform the S&P 500 during the next 12 months as the index climbs by 6% to our target of 2875," says Kostin.

Ok. That's all well and good. But let's take a look at reducing risk with some longer-term, deep-in-the-money covered calls and at-the-money covered calls on these names.

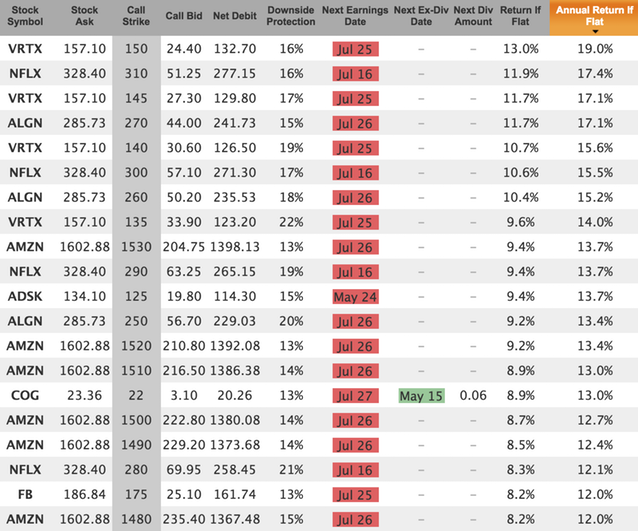

Deep In The Money Covered Calls

For more conservative investors, here are some 8-month deep-in-the-money covered calls on these names (expiration date of Jan 18, 2019) that generate more than 1%/month return (over 12% annualized return if flat):

One risk reducer to notice is that all of these have downside protection of at least 13%, and some of them are over 20%. That will come in handy should something go wrong and these names drop before January. (Note: downside protection is the sum of the moneyness (how much in-the-money an option is) plus the time premium, as a percentage of the underlying stock price. A stock could drop by that percentage between now and option expiration day before you'd have an unrealized loss.)

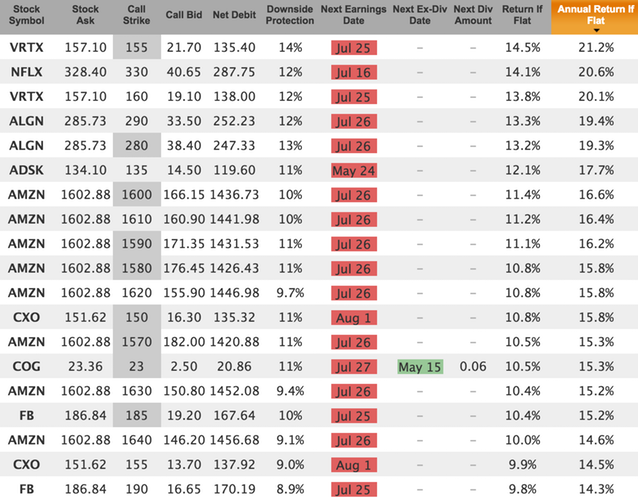

At The Money Covered Calls

For slightly more aggressive investors who are willing to trade more risk for higher reward, here are the at-the-money covered calls for the Jan 18, 2019, expiration:

Not quite as much downside protection (averages around 10%) but still enough to weather a 10% drop, in most cases.

2019 Is A Ways Away

Investing in what you think will be good in 2019 requires serious research today, as well as a belief that the macro market won't have a correction between now and then. And, any option held more than 3 months will have at least one earnings release during its lifetime (and those for January 2019 will have at least 2). Do your own research, keep your position sizes reasonable, and make sure they are appropriate for your personal risk/reward profile.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.