Safe Investing For Widows And Orphans

The title for this article was almost High Octane Investing For Widows And Orphans because surely that would generate more clicks than Safe Investing For Widows And Orphans (yawn). However, since we are serious investors helping people generate income with their nest egg, we are above using chicanery and click-baiting headlines (not withstanding the occasional April Fool's entry, such as Apple Downgraded To Screwed).

Safe Investing 101

What makes a stock appropriate for widows and orphans? It is a high quality stock that is stable and provides reliable dividend income in the event that the main breadwinner is gone.

For example, TheStreet.com named 3 companies in their article 3 High-Yield, Low-Risk Dividend Stocks for Extreme Safety, which they feel are widow and orphan appropriate. They are: JNJ, KMB, and PEP.

So Tame. Can You Make Money With Widow And Orphan Stocks?

Yes, but making money is not the main goal. The main goals for widow and orphan stocks are (1) provide income and, (2) don't lose money.

The stocks TheStreet.com chose all have current yields around 3%:

| Symbol | Recent Price | Annual Dividend | Dividend Yield |

|---|---|---|---|

| JNJ | 101.13 | 3.00 | 3.0% |

| KMB | 110.33 | 3.52 | 3.2% |

| PEP | 96.38 | 2.81 | 2.9% |

If you were to buy 100 shares of each, it would cost $30,784 and generate $933 in annual dividend income (3.0%). But we can increase that income by adding some covered calls.

Covered Calls For Widows And Orphans

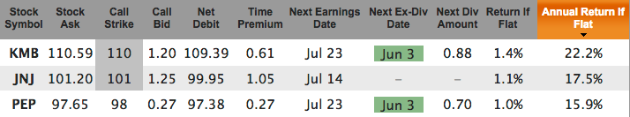

For the June 18, 2015, expiration, here are 3 covered calls:

If you were to buy 100 shares and write 1 contract (call option) on each of those, you would make $193 in time premium for the June cycle (sum of the Time Premium column). Note: we're using the call's bid price here, so you could do even better with limit orders at the midpoint of the current bid and ask.

If you could make $200/month then that's an additional $2400/year, or 7.8% of the $30,784 invested. If you add that to the $933 in dividend income, now you're generating $3,333 per year in income, or 10.8%.

What If You Need More Income?

If $3,333 isn't enough to live on then you'll need more shares, rather than taking higher risk with other stocks that may not be as suitable for widows and orphans. If, for example, you invested 10x as much ($307,784) then you'd have 1000 shares of each stock and generate $33,330 per year in income.

It takes quite a bit of capital if you want to invest it conservatively and live off the income. Yes, you could invest in covered calls on dividend paying stocks where the expected annual income is more than 10% but each time you increase the expected return you also increase the risk. For widows and orphans, they'd be better off saving as much money as they can and investing it in stocks like the ones TheStreet.com has identified. (No-one said the widows and orphans had to be poor -- they can have large nest eggs, too; just requires discipline)

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.